Is Costco Being Overcautious About Going Online?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Summary

Costco's online business is still at 3% of overall revenue, and there are no signs that they will step up their efforts significantly in the near future.

Their experimental model in the UK is now showing signs of success, and Costco may well be getting ready to roll out initiatives in core markets like North America.

They've already got Google Express tests underway in California and New York, but the purpose is to once again drive traffic to their warehouses.

Costco (NASDAQ:COST) seems to have a penchant for hitting a billion dollars in sales within six years wherever it goes. It was the first company in the world to achieve zero to one billion in sales within six years of opening shop. Now it has repeated the feat in Australia, where sales reached $1.3 billion in 2015, exactly six years after they entered the country.

Despite it's strong overall growth and the fact that it's loyalty programs is one of the best in the world, a big question that remains unanswered is why they haven't taken to the internet in a big way.

Costco's e-Commerce initiative is a case study in and of its own. The company has an online presence in only five countries: United States, Canada, United Kingdom, Mexico and Korea. Though they already have a physical presence in Australia, Spain and Japan, their web presence doesn't extend to these markets.

Additionally, Costco's UK and Mexico online services are widely different from what they are offering in their largest market - North America.

Originally, when Costco decided jump into the e-commerce bandwagon, it did so after putting a tremendous amount of time and research into figuring out whether it was worth the effort in the first place. Costco roped in Cisco Internet Business Solutions Group to analyze global online markets and find the best possible rollout plan.

Cisco IBSG recommended Costco start its online business in the UK first, a proposal that the company accepted, and started implementing in October 2012. To this day Costco UK remains the primary test market for the company. The company offers its UK online shoppers three different ways to shop online - something that its home market users in the U.S. aren't even aware of.

In the UK a non-member can buy Costco products online but will have to pay a 5% surcharge on the checkout price. Alternatively, they can choose to pay GBP15 (~$22) as an online subscription fee and avoid the surcharge. The third method is for the regular Costco executive and business members, who can either directly shop at one of their warehouses or buy online if they prefer.

So what are some of the key differences for a UK online buyer vs warehouse buyer?

- Greater choice - Costco.co.uk has some products that are not available in the warehouse

- Higher price - Due to shipping and handling fees for delivery online products are costlier than warehouse products

- Exclusive offers - Costco.co.uk provides exclusive online only offers

Since the UK is still technically a "test" market for their online business, none of this can lead to an assumption of a global roll-out. Even CFO Richard Galanti admits that:

"We're doing it methodically and we're not going to go crazy out there."

From Q4 2015 Earnings Transcript

"For the fiscal year, total e-commerce sales came in just under $3.5 billion, up a little over 20% for the year. Comp sales in e-commerce, again, were also up 20% for both the fourth quarter and the fiscal year."

So, it's clear that Costco is definitely exploring online sales as a legitimate revenue earner moving forward, but it also wants to be careful about cannibalizing its warehouse business, which is a tried and tested model - and has been for several decades.

Unlike Walmart's (NYSE:WMT) attempts to "convert" its customers to online ordering and product pickup, Costco is not ready to mix its wholesale business with its web business. Case in point is the fact that they haven't begun to promote the online option to their regular shoppers, which is what they would be doing if they wanted to go the Walmart route.

What Can They Learn From Amazon?

Possibly Costco's most important "guru" in the online space is Amazon (NASDAQ:AMZN), but not in a way that leaves Amazon looking good, unfortunately. You can sometimes learn more from the master with respect to what NOT to do rather than what TO do.

Amazon's biggest problem, as I see it, is shipping costs. Amazon Prime, for example, does not offer any major discount benefits to members like Costco does, but it does offer free two-day shipping on eligible products - and that's exactly the problem with Prime even though on the outside it seems hugely popular and growing with every year.

According to one source, the average order per Prime member (excluding digital product sales) was $47.31 in June 2012. Even if we retain that figure for 2015, at a spend of $1500 that means at least 30 orders over the year.

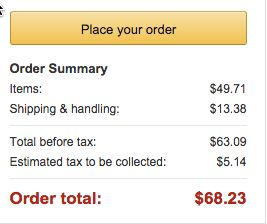

Now, Amazon already offers free shipping for products over $35, so a Prime customer making an order of $47.31 on average merely gets upgraded to two-day shipping free of cost. The cost of that shipping for the test order that I took to the final checkout page was not what I expected:

Look at that two-day shipping cost for a $50 product. If I were an "average" Prime customer, the company would essentially be footing a bill of $13.38 X 30 orders per year, or $400!

This is what I fail to understand: how can an average $400 shipping cost per customer be supported by the $99 subscription that they currently charge?

Out of that gross mismatch is where I believe lawsuits against Amazon are coming from. I cannot imagine that a company would spend anywhere near $400 per customer from its own pocket to meet the shipping needs of each "loyal" Prime member paying $99 a year.

It just doesn't make sense.

It can make sense, however, if they're able to get several customers who order fewer than 5 products a year for every customer for on whom they're spending $400 in shipping costs. Unfortunately, they don't have much control over who orders what. The best they can do is try and distract customers with additional offers for digital products that have zero shipping costs and, therefore, higher margins.

This, I hold, is the biggest lesson Costco can learn from Amazon. As the former forays deeper into cyberspace, it needs to ensure that the criteria below are met:

- Their revenue from the web does not eat into warehouse sales

- Their shipping costs are well covered under whatever membership benefits they plan to offer

Investor-speak: Is Costco Prepared to Fight an Online Battle with Amazon?

Understandably, Costco has been acting like a visually impaired tightrope walker as it tries to grow its online footprint without cannibalizing its predictable warehouse operations. On the other hand, they've clearly identified that online sales are more profitable than warehouse sales. This iswhat CFO Galanti had to say about that in the last earnings call:

"Online sales are more lucrative, too. That boost helped pad Costco's margins, leading to a surprise rise in earnings when most analysts expected the year to end on a down note. E-commerce is definitely quite a bit more profitable than the rest of the company."

That said, Costco is not going to get crazy and start rolling out massive features for online shoppers in the United States; at least, not until it has tested all its ideas in the UK and Mexico. Once they are confident of the after-effects of a solid e-commerce platform, Costco may well choose to roll out that model in North America.

The big advantage they have here over Amazon and even Walmart is that they will have a fully tested model in a market not so different from its core earners.

The other advantage with this approach is that the company can replicate all of its technology know-how in the U.S. market to an astoundingly short turnaround time...and that will be done at a time of its choosing - not because the market dictates it should, but because it's well and truly ready for it. It's like having a nice cash balance in an overseas account and bringing it back home when the economic climate is ideal for the move.

Costco doesn't want to depend on an online business to support its bottom line. More to the point, it wants the web to add to the top line of its warehouse business.

With the Google Express delivery experiments already underway in Los Angeles, San Francisco Bay Area and Manhattan, Galanti hopes that it will ultimately bring more people to their warehouses. Even the LivingSocial website promo they ran "worked well", according to Galanti.

From an investor's perspective, these are the best indicators of a company's healthy fiscal future - a robust core business model that's growing at a steady 6%, a successful and profitable test model that can be rolled out to core markets quickly, and a cautious management team that wants to strengthen its business by exploring new channels that can add to its main offering rather than cannibalize it.