Summary

- Circumstances that may alter J.C. Penney’s stock price.

- Which possible occurrence will most probably take place.

- In what manner should an investor participate?

The J.C. Penney Company is fated to make an extreme change

Is there anything that the J.C. Penney Company Inc. (NYSE: JCP) might do to avoid misfortune? A smudge of Macy's (NYSE: M) blood splattered upon its doorpost might turn the Angel from his path.

On February 26th J.C. Penney announced $12.254 B (my estimate $12.235 B) annual revenue and $771 M (my estimate $775 M) in losses for 2014. The results were within 1½% of my recent revenue and ½% of my earnings estimates.

It is important for an investor to discover how J.C. Penney is trending as direction will show whether a shareholder's equity will be diluted, lost, survive or increase.

J.C. Penney's future course is much more difficult to predict than the preparation of an estimate for its recent financial results. The following is a list of possible circumstances that may assist in foretelling the future of J.C. Penney and the conditions that may influence them.

Finally I will suggest which option is most probable and how investors may best use that information.

▪ J.C. Penney may reverse its ill fortune and may become profitable.

▪ The organization has reached the point of no return and will dissolve.

▪ J.C. Penney will dilute its shareholders' positions by issuing new stock.

Reverse of Ill fortune

If J.C. Penney can quickly increase sales and become profitable, it may avoid the need to make changes that will harm shareholders.

The effect of moderate increase in sales accompanied by a slight increase in gross margin, say a 5% sales increase and a 1% GM increase, over the preceding quarter will generate an immediate sizable increase in share price.

The stock price increase under these circumstances is easily forecast by observing that past increases in share prices occurred simply because positive results greatly outweigh optimistic rumors or the suggestion of positive results by management whether or not those results seemed probable. Any tangible improvement in JCP's business is apt to create a large increase in share price.

Dissolution of Business

It is possible that JCP's revenue will significantly decline, causing severe cash flow problems. JCP may no longer be able to service debt, and its options will then be to refinance debt or to dissolve its organization.

If J.C. the Penney management decides to terminate business operations it may declare bankruptcy or otherwise sell assets in order to satisfy creditors.

If J.C. the Penney management decides to terminate business operations it may declare bankruptcy or otherwise sell assets in order to satisfy creditors.

J.C. Penny has many off balance sheet assets such as the intrinsic value of its successful website, the worth of its iconic trade name and well-placed low-cost store locations. JCP could service a moderate portion of its debt if it dissolves its business.

Dissolution will mean loss of most or all of shareholders' equity.

Capital Infusion

J.C. Penney may discover that debt may become too burdensome to service. Revenue may increase slightly, enough to give hope for the future, but too little to assist with maintaining a sufficient level of cash flow to meet its needs.

The board may choose to seek a cash infusion. Creating more debt will be disproportionately costly and may cause existing debt to become so expensive that new borrowing will become prohibitive.

The best option may be to further dilute stock as it did in September 2013. Investor reaction to this will probably be severe distaste and will be likely followed by a decline in share price.

Which option probably will occur, and how should an investor participate?

▪ Is there a good chance that J.C. Penney's fortunes will reverse?

Management's promise of Omni-Channel's integration into its business seems to be misleading as its E-commerce efforts are mainly applied only to the single channel of Internet sales. Omni-Channel will not be J.C. Penney's savior.

J.C. Penney operations have shown little improvement since Ron Johnson's tenure. It has shown an increase in gross margin from its horrendous low point, but has not come close to its traditional gross margin. Success with increasing ecommerce sales has occurred, but the estimated $1.2 B in web sales only accounts for approximately 10% of JCP's total volume. Because of low margin in Internet sales, this venture has not generated large enough profits to significantly change J.C. Penney's fortunes.

It is unlikely that J.C. Penney will be able to raise GM above the 35% that it needs. An increase in gross margin may be accompanied with the possibility that it will lose a great deal of its customer base. JCP's continuous promotional activity may then no longer be believable.

Gross margin increase is not as simple to achieve as raising some prices by a few percentage points. It is a statistical process whereby prices of certain items are increased, making their new price level stand out.

If GM increases were so easy than organizations like Wal-Mart Stores (NYSE:WMT) would add a percent or two to its 25% GM in order to become amazingly productive.

There's little reason to believe that J.C. Penney's destiny will fortuitously improve.

▪ What is the possibility that J.C. Penney will be dissolved?

Stabilization in revenue, even if accompanied by moderate losses, probably avoids the necessity to dissolve JCP's business. Dissolution will not support the best interests of shareholders, employees, creditors or management. Closing is a last resort option, and JCP is far from this ending.

▪ Is it likely that restructuring of ownership and debt will occur?

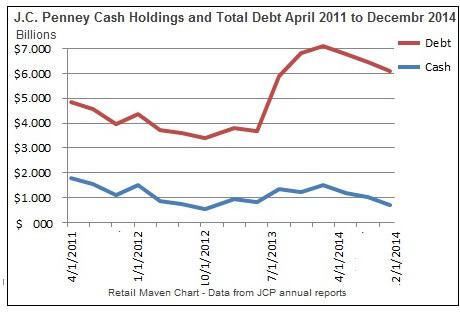

J.C. Penney's post-operational (not considering taxes) loss since 2011 year-end has been $4.420 B, which placed severe strain on its liquidity and cash position. Cash and short-term investments as of November 2014 amounted to $684 M, a reduction of $1.938 B from its January 2011 balance of $2.622 B.

Unless JCP upgrades its financial position before the next holiday season, it will not be able to purchase the necessary amount of inventory to do well during its most productive selling season.

It is best that JCP obtain capital now before its business is compromised by lack of funds.

This is the most likely event to occur as rapid recovery is unlikely and dissolution of the organization does not serve any of the participants. This means that its best opportunity is immediate issue of more shares, which disproportionately advantages new shareholders and injures present ones.

It is too late to profit on the latest news because the market has already reacted to the results of the recent reporting with an 11½ % after-market decline.

I suggest that price will bottom near the low point of the February 26th correction, $7.95, then quickly rise as the usual group of enthusiastic investors will bid the price higher once again followed by great volatility of about an $8.75 price point.

Look for the inevitable increase in stock price as Q1 reporting becomes closer.

J.C. Penney is a very speculative stock issue, and investors should participate cautiously with funds that they can afford to lose. JCP, because of its volatility and predictability, is a great day-to-day vehicle for speculators.

No comments:

Post a Comment