Have big consumer brands given up on innovation?

Can big consumer packaged goods (CPG) companies create, launch and grow truly innovative new products anymore? This was my first thought when I read of Dr. Pepper Snapple Group’s $1.7B acquistion of Bai Brands last week. It has always been part of the growth strategy for big companies to find early stage companies with a strong brands in emerging categories and leverage their core competencies of brand building, manufacturing and distribution to take the brand to the next level. And in many ways this strategy makes good sense — it takes significant effort (time and resources) to launch a new brand and as a big company with big quarterly growth projections such gambles typically don’t deliver immediate returns. Conventional wisdom would say that it’s easier to get a ‘deal’ on brand that has proven product-market fit and has solid traction and take it from there. But if acquisition is the sole source of innovation, what’s stopping the upstarts to flip the roles and take over the category — just take a walk down the yogurt aisle at your local supermarket to see how much space Chobani commands and consider the company was founded in 2005.

The Rise of the ‘Foodiecorn’

While Bai Brands was the most recent CPG ‘foodiecorn’ exit (food & beverage startups valued over $1B in case my cheesy naming didn’t make that clear!), over the past years they are becoming far more common occurrences. 2016 alone has seen several massive CPG acquisitions of startups across the consumer products spectrum with Unilever alone shelling out $1.7B for Dollar Shave Club and Seventh Generation ($1B and $700M respectively).

And more interesting to note is the fact that we seldom hear of big companies building their own new and truly innovative successful brand. In fact, it is far more common that we hear about the epic failures of new brand launched after being incubated in a big CPG organization — New Coke or Wow Chips anyone?! And most corporate innovation doesn’t even bother with developing a new brand, but rather focus on close-in innovation like flavor/line-extensions (yet another yogurt flavor) or existing brand expansion into new categories (your favorite chip brand now in the cracker aisle).

Consumer startups are increasingly getting more attention from the investment community and with over $238B in M&A activity in consumer and retail sectors in the U.S. alone last year, this trend doesn’t seem to be slowing down any time soon.

Startups are stealing big CPG’s lunch

Ryan Caldbeck, CEO of CircleUp recently wrote an interesting article on this very topic in Techcrunch. Ryan attributes big companies inability to innovate primarily to lack of R&D investment, the innovation risk in a quarterly results driven culture and lack of talent. While there is no disputing that consumer M&A is heating up and big companies too often prioritize hitting short-term goals over long-term transformation, I see things slightly differently in terms of big CPG company’s innovation challenge.

During my time as a brand manager at General Mills, the company acquired Larabar in an effort to expand build upon their growing natural and organic brand portfolio (comprised of other acquired brands like Cascadian Farm and Muir Glen) and has continued the strategy by bringing on more smaller healthy food companies like Epic Provisions (Annie’s) and Immaculate Baking in recent years. However, even with a healthy corp dev focus, I rarely felt that as an organization we weren’t focused on how consumer needs were evolving and having some of the smartest people I’ve met in my career think about how to meet these changing tastes. In my roles at the company, I was able to help launch the companies first eCommerce DTC offering (the now defunct myfruitrollups.com) and help build FiberOne into a massive brand while working on the FiberOne bar business (which helped deliver classic reddit threads like this).

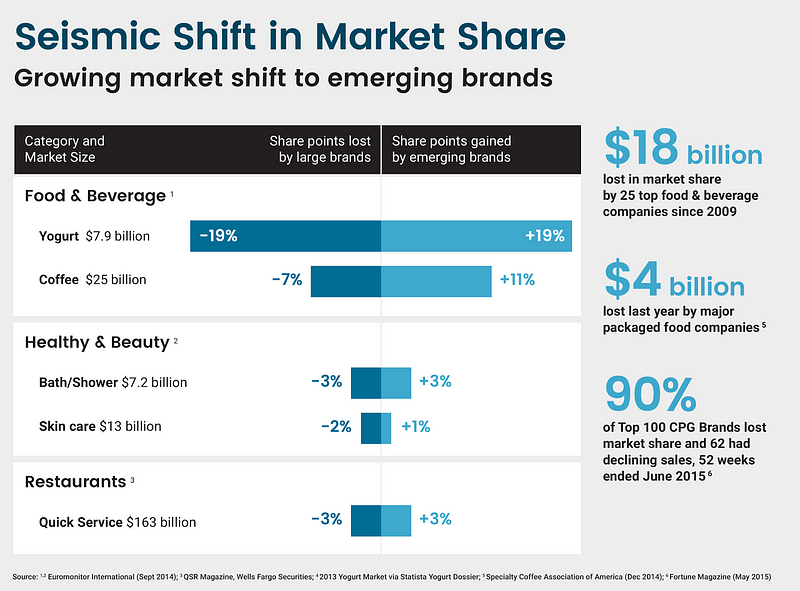

However, even with really smart people and world-class leading research, General Mills completely missed the boat on greek yogurt, opening the door for Chobani to take over the category in a few short years before Yoplait knew what hit them. And on this front, General Mills is not alone. CircleUp pulled data from a few notable categories illustrates that big brands are getting beat on market share to emerging brands who simply move faster and often take bigger swings on new products.

It’s not the people, it’s the culture

I don’t believe that big CPG companies lack great talent — i’ve never worked with smarter marketers, food scientists and professionals than my time in the industry. And while the focus on quarterly targets surely leads to a prioritization on step-change innovation, I believe that the lack of a culture that supports the spirit of innovation (test & learn, agile development, lean startup methodology) is the biggest issue — and this problem comes from the top of the organization vs. lacking the talent in the middle.

In my experiences at big CPG companies, we spent most of our time celebrating our wins in a big way and doing our best to quickly move on from our failures. A quick google search of ‘biggest product failures of all time’ brings you to numerous links showing some of best known flops of all time — but most recent examples are found in technology and automotive industries vs. big bets gone wrong in CPG categories.

The real problem is that big CPG companies forget what it takes to nurture and grow a brand from scratch and all the pain, setbacks and yes, failures, that come along the way. If CPG executives want to continue to drive leadership in the categories they compete, a good start would be to get back to the basics and empowering their employees to act like the emerging brands taking them on. If looking for a refresher on what that process is all about, a good place to start would be listening to Clif Bar’s Gary Erikson recount his journey on NPR’s How I Built This podcast.

In the end, the consumer M&A trend will be around for years to come, but if big CPG companies continue to rely on acquisition as their primary source innovation I fear many of these companies may not be around for the ride, either due to consolidation or the emerging brands of today flipping the roles completely and becoming the acquirers of tomorrow.

No comments:

Post a Comment