In Madison, they still struggle to accept that it’s really happening. On a not-yet-specified day before the end of March, a Kraft Heinz employee will turn off the lights in the sprawling Oscar Mayer plant, and for the first time in 98 years, no one will be coming back to work.

The facility was once the city’s largest employer, with over 4,000 workers transforming hogs, 900 an hour, into Oscar Mayer hot dogs, bacon, sliced ham, and more. Employment was down to about 1,000 when Kraft Heinz announced in 2015 that it would close the plant, and recently the workers had dwindled to about 400; the products still being made include an item called liver cheese, which few consumers under age 80 are clamoring for. No one knows what happens after March.

The facility was once the city’s largest employer, with over 4,000 workers transforming hogs, 900 an hour, into Oscar Mayer hot dogs, bacon, sliced ham, and more. Employment was down to about 1,000 when Kraft Heinz announced in 2015 that it would close the plant, and recently the workers had dwindled to about 400; the products still being made include an item called liver cheese, which few consumers under age 80 are clamoring for. No one knows what happens after March.

— - - —

Because the 50-acre site will need environmental remediation, its “value” is estimated at negative $10 million to negative $20 million. The city is scrambling to drum up interest in the site but was caught flat-footed; planners never imagined that Oscar Mayer would leave. Redeveloping so many acres won’t be easy. Madison Mayor Paul Soglin told a local publication, “It’s possible that given its size, it will take a decade or more to develop.”

So what happened? Why is a plant that provided good jobs to 1,000 people just 15 months ago being shut down? (Other than the liver cheese.) The answer explains a lot more than the fate of a Midwestern processed-meat factory. It also illustrates Kraft Heinz’s iconoclastic strategy under the hard-driving management of 3G Capital, the private equity firm overseen by Brazil’s richest man, 77-year-old Jorge Paulo Lemann. The answer even hints at the future of the U.S. food industry—and perhaps has global implications—because all evidence suggests that 3G is just getting started in an effort to transform this whole vast sector. But evidence also suggests that the 3G playbook, which has worked spectacularly well over the past 30 years, may not prove so effective this time.

So what happened? Why is a plant that provided good jobs to 1,000 people just 15 months ago being shut down? (Other than the liver cheese.) The answer explains a lot more than the fate of a Midwestern processed-meat factory. It also illustrates Kraft Heinz’s iconoclastic strategy under the hard-driving management of 3G Capital, the private equity firm overseen by Brazil’s richest man, 77-year-old Jorge Paulo Lemann. The answer even hints at the future of the U.S. food industry—and perhaps has global implications—because all evidence suggests that 3G is just getting started in an effort to transform this whole vast sector. But evidence also suggests that the 3G playbook, which has worked spectacularly well over the past 30 years, may not prove so effective this time.

YOU CAN BE forgiven if you’re not up to speed on the intertwined corporate marriages and divorces in the world of Big Food. Kraft Heinz came into being 18 months ago when Heinz bought Kraft Foods Group, a mostly U.S. grocery manufacturer that in 2012 had separated itself from a collection of mostly non-U.S. snack businesses now known as Mondelez International, an independent, publicly traded company that could reenter this saga before long. Heinz had been bought and taken private in 2013 by 3G Capital, with considerable financing from Warren Buffett. When it then bought Kraft and merged it with Heinz in 2015, 3G took the combined business public as Kraft Heinz. Buffett’s Berkshire Hathaway owns about 27% of the stock; 3G, about 24%.

Got that? While Buffett is the largest shareholder by a slight margin and has three seats on the board of directors, including one for himself, he’s happy to let 3G run the show. Back before they bought Kraft, he said, “I’m not embarrassed to admit that Heinz is run far better under [3G] than would be the case if I were in charge.”

The 3G management model that Buffett so admires is worth a close look because it’s on track to eat the food industry. At its heart is meritocracy, broadly defined. Every employee must justify his existence every day. That’s great news for the very best performers; they are promoted with speed that’s unheard-of in lumbering old food companies. Kraft Heinz CEO Bernardo Hees, for example, first became a CEO in 2005 at a company called All America Latina Logistica, owned by a 3G predecessor. He was then made CEO of Burger King, a 3G holding since 2010. He moved up to be CEO of Heinz in 2013 and now of Kraft Heinz. He’s only 46.

Got that? While Buffett is the largest shareholder by a slight margin and has three seats on the board of directors, including one for himself, he’s happy to let 3G run the show. Back before they bought Kraft, he said, “I’m not embarrassed to admit that Heinz is run far better under [3G] than would be the case if I were in charge.”

The 3G management model that Buffett so admires is worth a close look because it’s on track to eat the food industry. At its heart is meritocracy, broadly defined. Every employee must justify his existence every day. That’s great news for the very best performers; they are promoted with speed that’s unheard-of in lumbering old food companies. Kraft Heinz CEO Bernardo Hees, for example, first became a CEO in 2005 at a company called All America Latina Logistica, owned by a 3G predecessor. He was then made CEO of Burger King, a 3G holding since 2010. He moved up to be CEO of Heinz in 2013 and now of Kraft Heinz. He’s only 46.

PHOTOGRAPH BY THE VOORHES

Underperformers get fired with the same alacrity. Budgeted costs also are evaluated unsparingly every year, or more often, and are eliminated if they’re no longer judged worth incurring. After all, Hees (pronounced “Hess”) and other top executives are 3G partners. Their own money is tied up in each venture, and they can’t afford to be sentimental about it.

Which brings us back to the Oscar Mayer plant in Madison. The truth is, that plant should have been closed long ago, and everybody knew it. “The Madison plant was a terrible plant,” says John Ruff, a retired Kraft executive who spent much of his career in food-processing plants worldwide. “It had good people, but it was an old plant that had been added to over the years. It was never meant to be run as it was being run. Closing it was probably the right thing

Which brings us back to the Oscar Mayer plant in Madison. The truth is, that plant should have been closed long ago, and everybody knew it. “The Madison plant was a terrible plant,” says John Ruff, a retired Kraft executive who spent much of his career in food-processing plants worldwide. “It had good people, but it was an old plant that had been added to over the years. It was never meant to be run as it was being run. Closing it was probably the right thing

to do.” So why hadn’t Kraft closed it long before 3G came along? The reason is a classic problem for big, old businesses: People loved that plant. It was a treasured part of the company’s history. But not to 3G. “[Kraft] had trouble making tough choices,” says Credit Suisse analyst Robert Moskow. “3G has forced them to make tough choices, like closing the Oscar Mayer facility. It was very emotional.” Ruff agrees: “3G got rid of a lot of remaining emotional ties.”

Now project that philosophy across a $26 billion company. Step 1 in the 3G management model is a wholesale replacement of the top team and a blitzkrieg of cost cutting. At Heinz, 3G cashiered 11 of the top 12 executives in one day (as this publication chronicled in a 2013 story headlined “Squeezing Heinz”). When Heinz bought Kraft, 10 top executives were quickly dismissed. Of Kraft Heinz’s top 10 leaders today, eight are Brazilians from 3G who know the playbook. “If you don’t speak Portuguese, you’re at a bit of a disadvantage,” says a former Heinz director.

As with every 3G takeover, cost-cutting measures were imposed immediately after the takeover of Kraft. Office refrigerators long stocked with free Kraft products (cheese, Jell-O) were wheeled out within days of the merger’s closing. Corporate aircraft were ditched, and everyone from the CEO down was made to fly coach. And today employees on the road are sometimes required to double up in hotel rooms. More important than the actual savings is the message. “We think and act like owners of our business, treating every dollar as if it were our own,” the company tells prospective employees.

Now project that philosophy across a $26 billion company. Step 1 in the 3G management model is a wholesale replacement of the top team and a blitzkrieg of cost cutting. At Heinz, 3G cashiered 11 of the top 12 executives in one day (as this publication chronicled in a 2013 story headlined “Squeezing Heinz”). When Heinz bought Kraft, 10 top executives were quickly dismissed. Of Kraft Heinz’s top 10 leaders today, eight are Brazilians from 3G who know the playbook. “If you don’t speak Portuguese, you’re at a bit of a disadvantage,” says a former Heinz director.

As with every 3G takeover, cost-cutting measures were imposed immediately after the takeover of Kraft. Office refrigerators long stocked with free Kraft products (cheese, Jell-O) were wheeled out within days of the merger’s closing. Corporate aircraft were ditched, and everyone from the CEO down was made to fly coach. And today employees on the road are sometimes required to double up in hotel rooms. More important than the actual savings is the message. “We think and act like owners of our business, treating every dollar as if it were our own,” the company tells prospective employees.

The real savings take longer to implement. Kraft Heinz’s new leaders wasted little time announcing they would close seven plants in North America and consolidate production in other locations, eliminating some 2,600 jobs. (One of the seven, a plant in Fullerton, Calif., was recently given a reprieve due to strong demand for Lunchables.) Additional savings come from a second-order effect: States, cities, and labor unions, desperate not to lose their local facility, start offering incentives to the company to keep it open. In December, for example, Boone County, Mo., granted Kraft Heinz large tax abatements to keep operating its hot dog plant, with 40% fewer workers, even though it had not been scheduled to close. The company is closing a 71-year-old plant in Davenport, Iowa, but building a new one nearby—and getting $4.75 million in incentives in a deal that requires the new plant to employ only one-third as many workers as the old one.

Predictably, 3G does not favor grand corporate digs. It moved Kraft out of its lush suburban Chicago campus into one-quarter the space, occupying five floors of a downtown skyscraper. The floor plan is mostly open—lots of desks, few offices.

Predictably, 3G does not favor grand corporate digs. It moved Kraft out of its lush suburban Chicago campus into one-quarter the space, occupying five floors of a downtown skyscraper. The floor plan is mostly open—lots of desks, few offices.

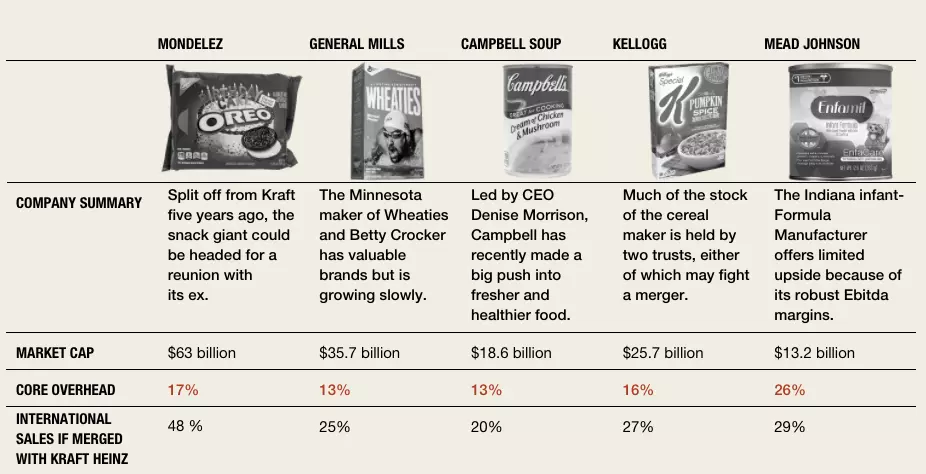

Kraft Heinz's Shopping List

WALL STREET IS BETTING, that Kraft Heinz will make a major acquisition soon—it’s already priced into the stock—and the big question is what. Though the company is mum, it clearly needs more sales outside the U.S., and the ideal target would carry some fat to be cut. Kraft Heinz is presumed to favor friendly deals, not hostile ones, and a target must be available at a reasonable price. Here’s how the top contenders stack up.

SOURCES: CREDIT SUISSE; STIFEL. COST-CUTTING OPPORTUNITY—CORE OVERHEAD AS PERCENTAGE OF REVENUE.

PHOTOGRAPHS FROM LEFT: ALAMY STOCK PHOTO; COURTESY OF GENERAL MILLS; ALAMY STOCK PHOTO; COURTESY OF KELLOGG; COURTESY OF MEAD JOHNSON

PHOTOGRAPHS FROM LEFT: ALAMY STOCK PHOTO; COURTESY OF GENERAL MILLS; ALAMY STOCK PHOTO; COURTESY OF KELLOGG; COURTESY OF MEAD JOHNSON

— - - —

SO FAR THIS sounds like a typical private equity strategy of slashing costs at a portfolio company and preparing for an exit in five years or so. But 3G is far from typical. To understand its unique MO and what it might portend for Kraft Heinz and the food industry, consider its highest-profile investment, AB InBev.

Lemann and his two partners, Carlos Alberto Sicupira and Marcel Herrmann Telles, bought a Brazilian brewer called Brahma in 1989. Then Brahma bought a big competitor, Antarctica, in 1999, and merged it with the giant Belgian brewer Interbrew in 2004, creating InBev. Its brands included Bass, Beck’s, Labatt, Skol, Stella Artois, and many others. Then, in an act of breathtaking ambition, InBev bought the world’s biggest brewer, Anheuser-Busch, in 2008 for $52 billion. And then, even more remarkably, AB InBev bought the world’s No. 2 brewer, SAB Miller, in the third-largest corporate acquisition in business history, paying over $100 billion. The deal closed last fall and gives AB InBev some 200 brands, including three that are marketed globally: Budweiser, Corona, and Stella Artois. The company brews almost one-third of all the world’s beer.

Note a few key elements of how this was done:

Unlike other PE firms, which have an exit in mind from the day they buy a company, Lemann and partners have stuck with their beer venture for 28 years and counting.

While the mergers with Interbrew and Anheuser-Busch required the partners to dilute their stake, they still dominate the board, with four of the 15 directors.

The pattern is buy, squeeze, repeat. The 3G managers developed extraordinary operating skills and greatly increased the value of every company they bought, but they were not great innovators. They achieved growth through acquisitions—not organically.

And there’s the rub: A central feature of this model is that it can’t work forever. It builds value only by buying more companies. “It’s like the shark that can’t stop swimming,” says a director of another major foodmaker. But AB InBev can’t apply the model further because it’s so big that antitrust authorities would never let it buy another significant brewer. So what’s next? Anyone who might know is not saying. Speculation in the industry is that since AB InBev can expand only outside its industry, its next target will be Coca-Cola.

Lemann and his two partners, Carlos Alberto Sicupira and Marcel Herrmann Telles, bought a Brazilian brewer called Brahma in 1989. Then Brahma bought a big competitor, Antarctica, in 1999, and merged it with the giant Belgian brewer Interbrew in 2004, creating InBev. Its brands included Bass, Beck’s, Labatt, Skol, Stella Artois, and many others. Then, in an act of breathtaking ambition, InBev bought the world’s biggest brewer, Anheuser-Busch, in 2008 for $52 billion. And then, even more remarkably, AB InBev bought the world’s No. 2 brewer, SAB Miller, in the third-largest corporate acquisition in business history, paying over $100 billion. The deal closed last fall and gives AB InBev some 200 brands, including three that are marketed globally: Budweiser, Corona, and Stella Artois. The company brews almost one-third of all the world’s beer.

Note a few key elements of how this was done:

Unlike other PE firms, which have an exit in mind from the day they buy a company, Lemann and partners have stuck with their beer venture for 28 years and counting.

While the mergers with Interbrew and Anheuser-Busch required the partners to dilute their stake, they still dominate the board, with four of the 15 directors.

The pattern is buy, squeeze, repeat. The 3G managers developed extraordinary operating skills and greatly increased the value of every company they bought, but they were not great innovators. They achieved growth through acquisitions—not organically.

And there’s the rub: A central feature of this model is that it can’t work forever. It builds value only by buying more companies. “It’s like the shark that can’t stop swimming,” says a director of another major foodmaker. But AB InBev can’t apply the model further because it’s so big that antitrust authorities would never let it buy another significant brewer. So what’s next? Anyone who might know is not saying. Speculation in the industry is that since AB InBev can expand only outside its industry, its next target will be Coca-Cola.

Warren Buffett’s Berkshire Hathaway owns 27% of Kraft Heinz, but he leaves the managing to his Brazilian partners from 3G Capital. Kraft Heinz CEO Bernardo Hees (left) previously ran Burger King for 3g.PHOTOGRAPHS: BUFFETT: KEVIN LAMARQUE—REUTERS; HEES: KEITH SRAKOCIC—AP

— - - —

THUS THE GREAT question: Is Kraft Heinz intended to be the AB InBev of food,dominating its industry so completely that the only remaining players are minor? 3G plays its cards very close to the vest—Hees declined to be interviewed for this article—and does not even offer earnings guidance to investors. But all signs say yes. The Brazil Journal blog reported in November that 3G is raising $8 billion to $10 billion to buy a global consumer goods company through Kraft Heinz. (3G won’t comment on the report, naturally.) Regardless of whether the report is accurate, an acquisition fits the pattern. It’s how 3G creates value. Plus, it’s about time. The firm bought Kraft two years after buying Heinz, and now it has been almost two years since the Kraft acquisition.

Investors are so sure that Kraft Heinz will make a big acquisition that they’ve priced one into the stock. By looking at analysts’ consensus forecast of profits, it’s possible to calculate a stock price that fairly reflects the present value of that future profit stream. When the EVA Dimensions consulting firm ran that analysis for Fortune on the basis of economic profit (after-tax operating profit minus a capital charge), it got a stock price for Kraft Heinz of $59. Actual recent stock price: $87.

The only way Kraft Heinz is worth that much is if it generates far more economic profit than anyone expects the company, as constituted, to generate. That is, investors are already betting on another big 3G-style acquisition. EVA Dimensions CEO Bennett Stewart concludes, “Kraft Heinz needs to add another Kraft Heinz, and at the right price—and the sooner the better.”

Investors are so sure that Kraft Heinz will make a big acquisition that they’ve priced one into the stock. By looking at analysts’ consensus forecast of profits, it’s possible to calculate a stock price that fairly reflects the present value of that future profit stream. When the EVA Dimensions consulting firm ran that analysis for Fortune on the basis of economic profit (after-tax operating profit minus a capital charge), it got a stock price for Kraft Heinz of $59. Actual recent stock price: $87.

The only way Kraft Heinz is worth that much is if it generates far more economic profit than anyone expects the company, as constituted, to generate. That is, investors are already betting on another big 3G-style acquisition. EVA Dimensions CEO Bennett Stewart concludes, “Kraft Heinz needs to add another Kraft Heinz, and at the right price—and the sooner the better.”

The whole U.S. food industry is speculating on who’s next. The leading candidate, somewhat ironically, is Mondelez, which would be remarrying its ex, Kraft, after only five years. Activist investor Bill Ackman’s Pershing Square hedge fund bought $5.6 billion of Mondelez stock just weeks after the Kraft Heinz merger closed, in what was widely regarded as a bet that Mondelez was 3G’s likeliest next target. (Ackman and Mondelez declined to comment for this article.)

For 3G, Mondelez’s attractions are several. Most important, it would help Kraft Heinz achieve one of its top priorities, expanding outside the slow-growing U.S. market. Kraft Heinz does only 30% of its business abroad; adding Mondelez would raise that number to 48% for the combined company. It would increase Kraft Heinz’s business in the fastest-growing food markets, the emerging economies, from 12% to 26% of sales. Mondelez also offers an attractive opportunity for 3G to work its operational magic because its Ebitda (earnings before interest, taxes, depreciation, and amortization) margin is only 18.3%, the lowest of the main potential targets. (The others are Kellogg, Campbell Soup, General Mills, and infant formula maker Mead Johnson.) That leaves a lot of room for Kraft Heinz to raise the margin toward its own towering 30%. One more advantage: Mondelez seems unlikely to resist a deal at the right price. Its board includes activist investor Nelson Peltz and Carlyle Group managing director Patrick Siewert, both ardent value seekers.

For 3G, Mondelez’s attractions are several. Most important, it would help Kraft Heinz achieve one of its top priorities, expanding outside the slow-growing U.S. market. Kraft Heinz does only 30% of its business abroad; adding Mondelez would raise that number to 48% for the combined company. It would increase Kraft Heinz’s business in the fastest-growing food markets, the emerging economies, from 12% to 26% of sales. Mondelez also offers an attractive opportunity for 3G to work its operational magic because its Ebitda (earnings before interest, taxes, depreciation, and amortization) margin is only 18.3%, the lowest of the main potential targets. (The others are Kellogg, Campbell Soup, General Mills, and infant formula maker Mead Johnson.) That leaves a lot of room for Kraft Heinz to raise the margin toward its own towering 30%. One more advantage: Mondelez seems unlikely to resist a deal at the right price. Its board includes activist investor Nelson Peltz and Carlyle Group managing director Patrick Siewert, both ardent value seekers.

Extreme Makeover

3G CAPITAL, the Brazilian private equity group that runs Kraft Heinz, has rapidly cut costs (and boosted market expectations) since merging Kraft with Heinz in 2015.

BEFORE...

EMPLOYEES

OVERHEAD

REVENUE

MARKET VALUE

BEFORE...

48,800

18.1%

$29.1 billion

$63 billion

...AND AFTER

41,000

11.1%

$26.8 billion

$105 billion

It’s easy to see why rumors of an imminent deal keep popping up, most recently in December (causing Mondelez’s stock price to jump 5%). But a closer look reveals at least one significant challenge to a deal. Mondelez’s widely dispersed global footprint could be a problem as well as an attraction. The 3G efficiency machine works best on big, coherent operations, not on far-flung operations in 165 countries. Dramatic improvements, which Kraft Heinz would need to produce, could be hard to achieve.

Other potential targets all pose problems as well. General Mills, which investors seem to consider the second-best bet for a deal, is slow growing and wouldn’t noticeably increase Kraft Heinz’s international exposure. Mead Johnson’s Ebitda margin is already almost as high as Kraft Heinz’s. Campbell Soup has a dominant shareholder, the Dorrance family, and much of Kellogg’s stock is held by two trusts, any of which might fight a merger, even at a good price.

Another, larger factor could frustrate Kraft Heinz’s search for a much-needed takeover target: The entire food industry is “3G-ing” itself before Kraft Heinz can do it to the companies. Ever since 3G bought Heinz, every major U.S. foodmaker has announced an initiative to reduce its overhead significantly. 3G embraces a demanding discipline called zero-based budgeting, in which every unit’s budget is assumed to be zero at the beginning of each year, and every proposed expense must be justified anew. What do you know? Soon after the Heinz deal, Mondelez adopted zero-based budgeting, trumpeting the expected savings to Wall Street. When Kraft Heinz was closing down plants and laying off workers last summer, General Mills announced it would close five plants and eliminate 1,400 jobs.

Back when 3G was rolling up the beer business, it was taken less seriously—an out-of-nowhere striver. Now everyone in the food business sees it coming and adapts. With fewer excesses left to wring out of target companies, the 3G model might not be as profitable as it used to be.

Kraft Heinz can still find opportunities, mostly because competitors can’t or won’t run the 3G playbook as well as Kraft Heinz does. The unsentimental reasoning with which the company closes plants is applied more broadly. For example, virtually every big company has too many projects underway, and they’re hard to pare back because each one has a constituency. Kraft Heinz trims them anyway under the mantra “fewer, bigger, better,” concentrating resources where they’re most effective; it’s worth the price of disappointing some people.

Other potential targets all pose problems as well. General Mills, which investors seem to consider the second-best bet for a deal, is slow growing and wouldn’t noticeably increase Kraft Heinz’s international exposure. Mead Johnson’s Ebitda margin is already almost as high as Kraft Heinz’s. Campbell Soup has a dominant shareholder, the Dorrance family, and much of Kellogg’s stock is held by two trusts, any of which might fight a merger, even at a good price.

Another, larger factor could frustrate Kraft Heinz’s search for a much-needed takeover target: The entire food industry is “3G-ing” itself before Kraft Heinz can do it to the companies. Ever since 3G bought Heinz, every major U.S. foodmaker has announced an initiative to reduce its overhead significantly. 3G embraces a demanding discipline called zero-based budgeting, in which every unit’s budget is assumed to be zero at the beginning of each year, and every proposed expense must be justified anew. What do you know? Soon after the Heinz deal, Mondelez adopted zero-based budgeting, trumpeting the expected savings to Wall Street. When Kraft Heinz was closing down plants and laying off workers last summer, General Mills announced it would close five plants and eliminate 1,400 jobs.

Back when 3G was rolling up the beer business, it was taken less seriously—an out-of-nowhere striver. Now everyone in the food business sees it coming and adapts. With fewer excesses left to wring out of target companies, the 3G model might not be as profitable as it used to be.

Kraft Heinz can still find opportunities, mostly because competitors can’t or won’t run the 3G playbook as well as Kraft Heinz does. The unsentimental reasoning with which the company closes plants is applied more broadly. For example, virtually every big company has too many projects underway, and they’re hard to pare back because each one has a constituency. Kraft Heinz trims them anyway under the mantra “fewer, bigger, better,” concentrating resources where they’re most effective; it’s worth the price of disappointing some people.

PHOTOGRAPH BY THE VOORHES

Not many companies would put everyone including executives on a simple $50 per diem for food while traveling. But doing so not only saves money directly, it also frees managers from low-value hours of inspecting expense reports for rule violations. The company’s extreme meritocracy is too intense for many corporate cultures, but it attracts exactly the people 3G wants—“fanatics,” as they put it. Management guru Jim Collins, who has worked with 3G for over 20 years, believes fanatics are key to 3G’s success. “Such obsessed people do not become the most popular people, as they often intimidate others,” he writes, “but when fanatics come together with other fanatics, the multiplicative effect is unstoppable.”

Combine those policies, relentlessly enforced, and the result is operational superiority. Major competitors are diminishing Kraft Heinz’s lead, but it’s still a big lead.

Combine those policies, relentlessly enforced, and the result is operational superiority. Major competitors are diminishing Kraft Heinz’s lead, but it’s still a big lead.

— - - —

THE GREATER THREAT to Kraft Heinz becoming the AB InBev of food is its ability orinability to handle the long-term shift in consumer tastes. The growing preference for fresher, healthier products is a crisis for Big Food, and some players are taking risks to confront it aggressively. Campbell Soup under CEO Denise Morrison is betting heavily on fresh foods, though it has little expertise in that area. Hormel, famed for Spam, has performed extraordinarily well by creating such utterly un-Spam-like products as peanut butter snacks, a pea-based protein shake, and a food service burger made with chicken, quinoa, and kale.

But Kraft Heinz isn’t going that way. Under the policy of “fewer, bigger, better,” it’s focusing innovation on a few “big bets” that are mostly tweaks of famous, old Big Food products: Jell-O (invented in 1897) reformulated without artificial flavors, dyes, or preservatives; shelf-stable mac and cheese (1937) made with better cheese; Velveeta (1918) cut into smaller blocks. Those products are performing well, but they seem a tepid response to the industry-shaking reality of growth shifting strongly from the center of the supermarket, where those products reside, to the perimeter, where the fresh foods live.

But Kraft Heinz isn’t going that way. Under the policy of “fewer, bigger, better,” it’s focusing innovation on a few “big bets” that are mostly tweaks of famous, old Big Food products: Jell-O (invented in 1897) reformulated without artificial flavors, dyes, or preservatives; shelf-stable mac and cheese (1937) made with better cheese; Velveeta (1918) cut into smaller blocks. Those products are performing well, but they seem a tepid response to the industry-shaking reality of growth shifting strongly from the center of the supermarket, where those products reside, to the perimeter, where the fresh foods live.

Weak innovation is one reason Kraft Heinz has been shrinking, not growing. Revenue in 2016 was likely about 3% less than in 2015, which was almost 6% less than combined Kraft and Heinz revenue in 2014. The company gave up some business willingly as it focused on the best uses of capital. But that process is mostly done, and analyst forecasts for this year and next show inflation-adjusted revenue as flat.

Kraft Heinz today illustrates the essential 3G: quite possibly the world’s best at creating value by eliminating costs and focusing on the most promising opportunities, but not adept at growing the top line organically. In such a model, performance is front-loaded in the years right after an acquisition. Analysts expect Kraft Heinz profits to increase by smaller percentages each year.

That’s why the shark must keep swimming. Even as the food industry changes—and as competitors learn how to make themselves slightly less appetizing prey—Kraft Heinz can probably find enough acquisition targets to keep its model going for years.

But what if Kraft Heinz fully becomes the AB InBev of food and someday finds nothing left to buy? For now, the unsentimental, analytical response is to note that such a risk is a long way off, and discounted to the present, it doesn’t amount to much.

Kraft Heinz today illustrates the essential 3G: quite possibly the world’s best at creating value by eliminating costs and focusing on the most promising opportunities, but not adept at growing the top line organically. In such a model, performance is front-loaded in the years right after an acquisition. Analysts expect Kraft Heinz profits to increase by smaller percentages each year.

That’s why the shark must keep swimming. Even as the food industry changes—and as competitors learn how to make themselves slightly less appetizing prey—Kraft Heinz can probably find enough acquisition targets to keep its model going for years.

But what if Kraft Heinz fully becomes the AB InBev of food and someday finds nothing left to buy? For now, the unsentimental, analytical response is to note that such a risk is a long way off, and discounted to the present, it doesn’t amount to much.

No comments:

Post a Comment