Starbucks and Amazon go cashless in Seattle

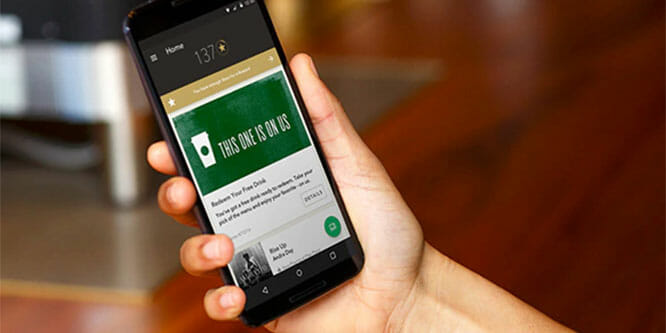

Photo: Starbucks

Jan 25, 2018

A Starbucks in Seattle isn’t interested in your cash. In fact, it won’t accept cash should you try to use it as payment for your purchase.

The store located inside the Russell Investments Center in the city’s downtown area is the only one running a test of cashless payments, according to the company. The purpose of the test, a Starbucks spokesperson told The Seattle Times, is to “understand how cashless forms of payment may impact our customer experience.”

Starbucks has continued to emphasize its mobile order and payment app as means to engage with its customers and better manage traffic flow in its stores. When the coffee giant announced the closing of its online store on Oct. 1 of last year, a spokesperson emphasized the chain’s focus on “amplifying Starbucks as a must-visit destination” using the mobile app and the company’s rewards program as key drivers towards that goal. Starbucks reported that mobile order and pay accounted for 10 percent of all transactions in its fourth quarter 2017 operating results.

While the test by Starbucks has captured headlines, it is not the only business selling food and drinks to take the cashless route.

On Monday, Amazon opened its Go convenience store concept that operates without the need for cash or cashiers. When a shopper takes an item off a shelf, it is automatically added to their virtual shopping cart. Amazon bills the customers’ accounts when they leave the store and posts receipts to the app.

Tender Greens, a fast-casual restaurant chain with 26 locations, announced on Jan. 15 that it was going cashless. The company’s founders explained in a blog post that since starting the business in 2006, they had seen the percentage of cash transactions drop into the single digits. After testing a cashless approach to the business, they discovered “guests were getting through the line faster and our teams were getting back hours of time to do more interesting and meaningful things.”

While going cashless is something that may not bother the growing number of people who choose to use other forms of payment, there is concern that it discriminates against consumers who may not have access to non-cash forms of payment.

- Starbucks tests no-cash policy at downtown Seattle store – The Seattle Times

- Amazon Go goes live – RetailWire

- We’re Going Cashless – Tender Greens

- Starbucks Q4 FY17 Financial and Operating Results – Starbucks

- Should Starbucks close its online store? – RetailWire

DISCUSSION QUESTIONS: Do you think cashless restaurants and stores are going to become ubiquitous in the near future? Does not accepting cash represent a form of discrimination?

Join the Discussion!

You must be logged in to post a comment.

Yes, I do believe that cashless will become ubiquitous in certain categories in the near future, however, I don’t expect cash to go away entirely for some time to come. While one might argue that not accepting cash is a form of discrimination, I don’t agree. Merchants are free to accept whatever payment they choose, and not accepting cash is a choice they can rightly make. This, I would argue, is a form of segmentation — they are merely catering to a segment of the market they are interested in.

I can see a small percentage of customers not being happy and choosing to take their business elsewhere. When toll booths began to offer EZ Pass or, depending on your state, a different program, many drivers jumped at the opportunity. However, you still have a small percentage today refusing to get EZ Pass. For some, it might be they have no means to pay for it like an active credit card, but for many others they wish to protect their privacy. I see the same issue here with some customers not being able to establish credit to use the app but with many others who prefer not having Amazon, Starbucks or whatever company tracking them. Lastly, there are those who for a quick purchase prefer using cash. However, Amazon, Starbucks and all the others who go cashless will eventually win because cash is going and will continue to go away. It’s part of today’s progress and technology moving us forward.

Ubiquity for cashless stores is far, far off. The headlines are cool, but the realities are challenging.

For grab and go scenarios where merchandise is taken off the shelves and stealthily charged, the technological hurdles are immense. As inventory size scales from a convenience store on up, the challenges become exponential. Shrinkage and the cost of implementation/maintenance will gouge profits and grocery stores (where a lot of this talk comes from) are already profit sensitive.

As a 1:1 replacement for cash without the grab and go aspect, the prospect for big rollouts is brighter, but aside from such a system needing to be 99.999 percent flawless, the mountain that has to be moved is human nature. Credit cards took decades to get to the level of ubiquity they relish in (in Western countries at least). Cashless payments will scale faster, but not anywhere close to overnight. Until people slowly gain trust and see personal benefits, such as ease and time savings, they will barely budge.

Every dollar bill says that “this note is legal tender for all debts, public and private.” While accepting cash is expensive (IHL Group just did a study outlining the costs of cash handling) there’s no question that not accepting it is outside the law. Watch for lawsuits defending the rights of the poor to use cash to purchase that cheese danish.

Cathy, I don’t believe your statement about accepting cash is accurate. Here’s a note from the Federal Reserve’s website:

“Is it legal for a business in the United States to refuse cash as a form of payment?

Section 31 U.S.C. 5103, entitled ‘Legal tender,’ states: ‘United States coins and currency [including Federal reserve notes and circulating notes of Federal reserve banks and national banks] are legal tender for all debts, public charges, taxes, and dues.’

This statute means that all United States money as identified above is a valid and legal offer of payment for debts when tendered to a creditor. There is, however, no Federal statute mandating that a private business, a person, or an organization must accept currency or coins as payment for goods or services. Private businesses are free to develop their own policies on whether to accept cash unless there is a state law which says otherwise.”

Perhaps the caveat is that retailers and service providers must make their cashless policy clear before customers consume goods or receive services, and therefore incur a “debt?” Individual states may also have their own laws or whether or not cash must be accepted as a form of payment.

Hi Mark, I think Cathy’s point is that there has been an underlying assumption on the part of consumers that businesses would accept what has been called “cash money.” It may be legal for businesses to refuse cash, but it does send a signal to the unbanked that their business is not wanted. My guess is the unbanked aren’t buying coffee in Starbucks or shopping at Amazon Go anyway, but it does seem to be a bit of an elitist position on the part of these businesses.

The “cashless” approach is obviously here to stay. It is not only about cashless, but rather about seamless checkout, paying via an app or seamlessly via face recognition technology, etc. If you want to see the future of cashless payments just look at China, where already the majority of payments in restaurants, and in any type of store including street stalls, are made by scanning a barcode on the consumer’s phone or by face recognition charging a consumer’s virtual wallet.

The West is far behind China in the adoption of these payment schemes mainly because of lack of a standardized payment platform such as WeChat that has in China over 400 million active users who use their mobile wallet to buy anything from food to plane tickets.

Growth in cashless: yes. Ubiquitous: no. Millennials prefer cashless transactions, but many people still rely on cash to make purchases. In a way, cashless is a form of discrimination towards the poor and non-urban. And as I say to my friends in Southern California, how well are your credit cards and cell phone going to work when there is no electricity after an earthquake?

Since most consumers carry a cash alternative for payment this is not such a bold move for a downtown Starbucks. Surely it will reduce cash out processing time, back office cash handling costs and offer more insights into their customer’s lifestyle. Low risk – high reward.

We are clearly entering into a cashless world, particularly for quick service, convenience-focused items. Amazon and Starbucks are the innovators in this arena. Starbucks has already created a seamless mobile app that is fully integrated with their rewards program and provides benefits in the form of points and a free coffee after you accumulate enough points. Amazon, along with Alibaba, have a vertical integration that will only grow and expand as they penetrate the brick-and-mortar arena.

However, even with all the incentivization, not everyone has the ability to shop exclusively with a mobile app or go completely cashless. This will create a segmentation of folks who shop with their mobile apps, prefer to shop cashless and those who strictly use cash. Merchants have the inherent right to decide which payment they accept. Yet cash should remain a viable option, especially during this period of rapid technological disruption.

We’re behind on this. Sweden, the most “cashless society on earth,” had barely 1 percent of all transactions done with coin and note last year. Of course we’re not Sweden and we have a much broader range of consumers on the socioeconomic scale. Which is where the idea falls down in the U.S. Or why we need to go a little slower than Sweden.

We designed a grocery store in Chicago called Standard Market whose owners insisted on being cashless at first. It did not work and several people were shocked at that fact. So cashless, at this stage of our retail development, definitely needs to be tested first and rolled out only to specific demographics. Personally though, I love it — let’s get going!

Two questions; two answers. Cashless restaurants and stores will become ubiquitous, but not in the near future. A whole generation of people (55 and older?) has to pass on before that happens. Not accepting cash is a form of discrimination and there are people who, because of economic standing or privacy concerns, cling to cash as the only — or at least preferred — tender. Imaging giving an indigent person a dollar to go get a doughnut, and Dunkin’ Donuts turns the indigent person away because s/he doesn’t have a smartphone. Even if the retailer is insensitive to it, others will bring light to the issue.

Generation Z and Millennials tend not to carry cash. As a result, companies that focus on these target markets will need to address their payment and checkout policies accordingly. While I understand the concerns about discrimination, I am less inclined to see these as legal issues or make-or-break initiatives and more about convenience in terms of speed of checkout and ease of payment. Ubiquitous? No. An emerging trend? Yes.

Cashless is going to be ubiquitous, but not anytime soon. Mobile pay has been slow to take and, while growing, doesn’t look like it’s going to overtake cash anytime soon. There are upsides to this — it allows you to be able to put customers on lists right away and track purchase patterns. I understand the movement towards cashless.

Having said that, the number of households in the U.S. that don’t have a bank account sits around 7 percent, which as a percentage seems low, but is still 22 million households, not including individuals that aren’t counted in “households.” That makes for a considerable amount of folks to alienate by going cashless.

There are also several places in the Washington D.C. area that don’t accept cash. But there are also many small businesses across the country that still encourage cash, and even offer a discount for customers who pay with cash. Cashless payments are faster and easier for employees. But retailers also pay a fee every time someone pays with plastic. If that becomes the new norm, will customers pay higher prices to offset that cost?

It was just a matter of time. In 1997 Bill Gates wrote “The Road Ahead” and covered the concept of a cashless experience. So, let’s adopt, adapt and get comfortable with the idea. How long will it take for it to be the only form of payment? Hard to say, but we’ll see more and more stores adopting the technology to go cashless.

Remember when restaurants had notes on their menus or signs on their doors “Cash Only”? Now I see “We do not accept cash.” Oh, how things have changed.

Really! Another reason to go to a local coffee shop. Cash is going to be around for a long time folks, and it keeps me from overpaying for stuff I don’t need. Starbucks is very tech-forward, and many folks love them, whereas I do not but again that’s me. My $10 bets on the golf course are played for cash, and I want to choose when I use my debit or credit card, not be forced to do it because Starbucks says so. The cell phones don’t fit into slot machines or blackjack tables either, just saying.

I agree that “cashless” is a growing trend but will never entirely replace cash transactions in a society that is much less economically homogeneous than, say, Sweden. Airlines were early adapters of this model because they only accept debit or credit cards for in-flight purchases, and customers have caught up to the trend.

Over time, customers will self-select: If they prefer cashless transactions, they will find the retailers (Amazon Go, etc.) that only offer that option. Amazon Go actually takes it a step further because there are no credit card transactions either.

I remember when chip and pin was launched in the U.K. and hearing a woman say that she would never shop in a specific store again if they weren’t going to allow her to keep signing receipts to pay by card. The idea that it wasn’t just that store was lost on her. Obviously the move to cashless isn’t quite the same (at present cash as a concept isn’t disappearing), but I think there may come a point when the number of places that are cashless only, or cashless first, outweighs those that take cash. That may then cause a snowball effect where cash gets squeezed out (eventually). How quickly this happens depends on the type of cashless payments we’re talking about — stores that only take cashless payments by debit or credit card are likely to be more widely accepted faster than stores that use facial recognition or stores with the tech capability of Amazon Go. It’s about that marriage of cost and what customers are comfortable with. We’re all used to paying with… Read more »

It’s all about the customer, right? If your customer base, or the one you are targeting, is fine not using cash then go for it. Otherwise, don’t throw out the cash drawers just yet. For my 2 cents.

Try buying a snack on most airlines with cash … the airlines don’t want to get into a “deposit the cash” after the flight lands business either. Convenience (and cost) goes both ways. There’s bound to be a growing sector where cash is no longer welcome.

Exclusive digital transactions are not only the wave of the future, they are what younger generations are already used to. It was significant use when most airlines went cashless, but now it is but a footnote. Mass adoption of apps and tools like Zelle and Venmo will only accelerate the ubiquity of cashless outlets bringing ease — and lower fraud and slippage.

You won’t accept my cash; I won’t shop your store. Why? Because I am one of the millions in the U.S. who don’t have a credit card. I like to use cash for smaller purchases so I can control my spending, etc. Cash may not be King, but there are many retailers would be very happy to have you spend it their locations.

Please the customer and provide the experience they want and expect. Cashless is an option that many consumers will embrace. But failure to offer a variety of payment options chips away at the total customer service expectation resulting in erosion of the total brand experience. A company saves nothing by losing a sale so keep offering the payment options or chip, chip, chip.

In the near future? Maybe, but only in some regions and for certain types of stores & restaurants. We’ve already experienced this on airlines that no longer accept cash for in-flight purchases, but I’m not sure we’re going to see rapid adoption of cashless everywhere.

While this can work well in urban and most suburban areas where populations are carrying less cash (yes, Millennials, and Gen Z, but many Gen Xers I know act the same), but outside those areas and demographics, it’s going to be much more difficult. Is it discrimination? Some may say it is, but that almost feels like saying if a merchant says they accept only cash it would be discrimination against those who shop with credit cards or by check!

Thanks for this blog.

ReplyDeleteHoney in Pakistan

Parkview City Payment Plan

seo services in lahore

Termite Treatment in lahore

hearing aids in lahore

speech therapy in faisalabad