Why The Sainsbury / Asda Merger Is Necessary But Not Sufficient

Sainsbury (OTCQX:JSAIY, OTCQX:JSNSF), Asda (NYSE:WMT) and the other large UK supermarkets are currently engaged in an all-out price war with Aldi and Lidl.

While price wars may be good for customers, they are rarely good for companies, their profit margins or their shareholders.

Sainsbury and Asda are hoping to protect their profit margins and shareholders by combining their businesses.

As a single business, they should be able to:

- Make their combined distribution network more cost effective (by sharing warehouses, for example), and

- Negotiate harder with suppliers as their combined purchase orders will be that much larger.

Both of these will lower Sainsbury's and Asda's expenses, which should make the company more competitive, more profitable and more appealing to investors.

In my opinion, this merger (or something very similar to it) is a necessary step for Sainsbury, as it appears to be in a lot of difficulty at the moment.

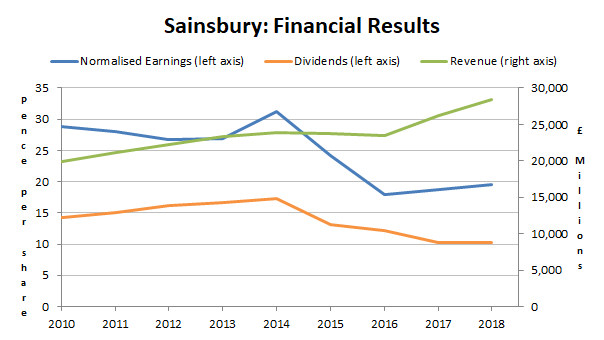

Sainsbury: Negative growth, low profitability and high debts

Sainsbury has struggled to cope with the post-financial crisis world.

Sainsbury has struggled to cope with the post-financial crisis world.

When I'm looking at a company, there are three absolutely essential features I look for:

- Reasonable profitability: Profits re-invested into fixed and working capital assets, such as stores, warehouses and stock, should generate a return of at least 7% per year (and preferably much more).

- Inflation-beating growth: Relatively consistent growth which is, at the very least, beating inflation.

- Balance sheet strength: Prudent debt and pension obligations which the company can easily manage during tough times.

Somewhat surprisingly, Sainsbury does not meet any of these criteria. Instead, it has:

Negative growth: Sainsbury's ten-year growth rate, averaged across revenues, earnings and dividends, is minus 2.8%. Add in inflation at about 2% and the company has been shrinking by almost 5% per year (in real terms) for the last decade.

That breaks one of my most basic investment rules:

Investment rule: Only invest in a company if its ten-year growth rate is above 2%.

Paltry profits: For a company of its size, Sainsbury makes very little profit.

Looking at profit margins after tax, over the last ten-years the company generated average revenues of £23.6 billion and average profits of £0.5 billion. That gives Sainsbury an average profit margin of just 2%, which is terrible.

Alternatively, Sainsbury produced average post-tax returns on capital employed (ROCE) of just 5.4% per year. In other words (and somewhat simplistically), each pound of earnings reinvested in stock, warehouses and stores returned just 5.4% per year.

If management had instead paid out those earnings as a dividend, investors could have achieved far better returns by reinvesting them into more profitable businesses, or even just a simple index tracker.

As you might have guessed, this also breaks one of my investment rules:

Investment rule: Only invest in a company if its ten-year return on capital employed is above 7%.

Towering debts: According to its 2018 annual results, Sainsbury has borrowings of almost £2.3 billion, which is more than five-times its recent average profits (giving it a "debt ratio" of more than 5).

That breaks yet another investment rule:

Investment rule: Only invest in a defensive sector company if its debt to five-year average profit ratio is less than five.

The situation gets even worse when you factor in the £10 billion Sainsbury pension scheme. That's more than 20-times the company's recent average profits, and so that also breaks one of my rules:

Investment rule: Only invest in a company if its pension fund to five-year average profit ratio is less than ten.

This combination of negative growth, weak profitability and large financial obligations is a potentially explosive cocktail.

That's why I'm not surprised to see Sainsbury desperately seeking a deal with Asda.

Asda, as far as I can tell, is in a much better position than Sainsbury.

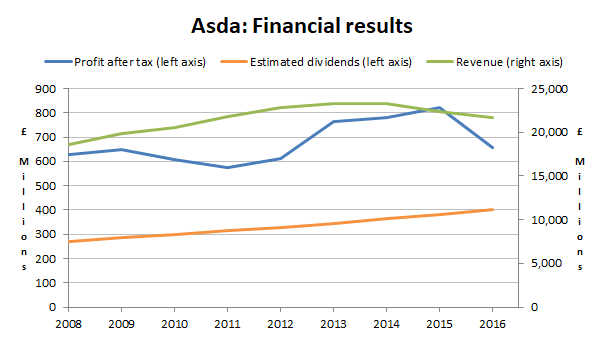

Asda: Positive growth, higher profitability and lower debts

Asda appears to have done better than Sainsbury.

Asda appears to have done better than Sainsbury.

First off, there are a couple of things I should point out here:

- Asda's results only go up to 2016 because it's a wholly owned subsidiary of US supermarket giant Walmart and more recent results are not yet available. However, Companies House does have Asda's annual results up to 2016, so that will have to do.

- The dividends in the chart above are an approximation of what might have been paid out if the company had been listed on the UK stock exchange. In reality, Asda's dividends were all over the place because, as a wholly owned subsidiary, it has great flexibility in any dividends paid to its parent company.

Those limitations aside, Asda's results do appear to be better than Sainsbury's (although they're not exactly awe-inspiring). Asda has:

Reasonable growth: Asda's ten-year growth rate, averaged across revenues, profits and dividends, is 3.4% per year. That's better than inflation, so it doesn't fall foul of my growth rule.

Acceptable profitability: The company also has relatively impressive levels of profitability for a supermarket.

Its ten-year average profit margins are still wafer-thin at 3.1%, but that's 50% better than Sainsbury's 2% profit margin.

The same goes for returns on capital employed. Asda has a ten-year average ROCE of 9.7%, which is almost double Sainsbury's 5.4%. As with Asda's growth rate, this is good enough to avoid breaking my rule on profitability.

Manageable debt and pension liabilities: Asda has less than £0.2 billion in borrowings, which is peanuts for a company making almost £1 billion in profits each year.

On the pension side of things, the picture is not quite so good, as there is a pension obligation of about £3.4 billion. However, that's less than five times Asda's recent average profits, so it's comfortably within my rule on pension fund size.

Overall, Asda appears to have done a better job of coping with the price war of the last five years. And that's good, because the last thing Sainsbury needs is to merge with a company that's even less competitive than itself.

So that's the back story on each individual company, but what will happen if they're merged into one?

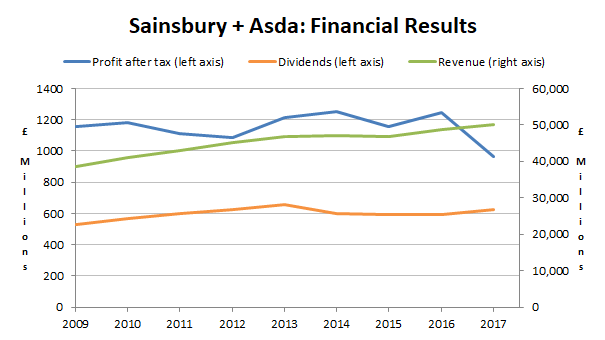

Sainsbury + Asda = Greater economies of scale

Sainsbury's and Asda's combined results are slow but steady.

Sainsbury's and Asda's combined results are slow but steady.

The chart above shows the combined histories of Sainsbury and Asda as if they had been one company all along.

These financial results are perhaps what you might expect from a very large, mature, geographically restricted company operating in a highly competitive market. In other words, they're just not that impressive.

For example, the combined growth rate of the two companies is just 1.2% and the combined profitability (ten-year ROCE) is just 7%. Both of those numbers are below average for an FTSE 100 company.

Of course, Sainsbury and Asda think the merger will improve their competitive positions, their profit margins and their growth rates, thanks to greater economies of scale and greater bargaining power. And I think they're right.

I think the merger is necessary for the survival of both businesses, especially now that Tesco (OTCPK:TSCDF) has massively increased its own scale by taking over Bookers, the UK's largest food wholesaler.

However, while the merger may be necessary, it isn't sufficient to make me want to invest.

Sainsbury + Asda = Greater uncertainty

One big problem with investing in Sainsbury today is the amount of uncertainty.

Investing is hard enough without deliberately getting into situations where change, disruption and uncertainty are off the charts. And that's what mergers often bring.

There are countless issues that need to be addressed when two companies are brought together, and the results are often not pretty. Just look at Morrison's (OTCPK:MRWSY) acquisition of Safeway for an example of how it can all go horribly wrong.

There are many important lessons to learn from the mistakes of others, and one lesson I've learned is this:

Investment lesson: Avoid companies that have spent more on acquisitions in the last decade than they made in profits.

And that's exactly what Sainsbury will have done if this merger goes ahead.

And if the merger doesn't go ahead?

If the merger doesn't go ahead, I still wouldn't invest in Sainsbury because its growth rate is negative, its profitability is shockingly low and its debt and pension obligations are worryingly high.

No comments:

Post a Comment