Titans Of China Series - Volume 2: Alibaba

Summary

Alibaba has an incredible flywheel similar to Amazon.

However, the business models of these two companies are fundamentally different.

Alibaba is still a strong business with great financials that make this a great company for a long-term holding.

The second titan in our series is none other than the great Alibaba (NYSE:BABA). Jack Ma’s brainchild is probably one of the more well-known Chinese companies and just like Tencent (OTCPK:TCEHY), it has its fingers in many different pies.

Investment Thesis

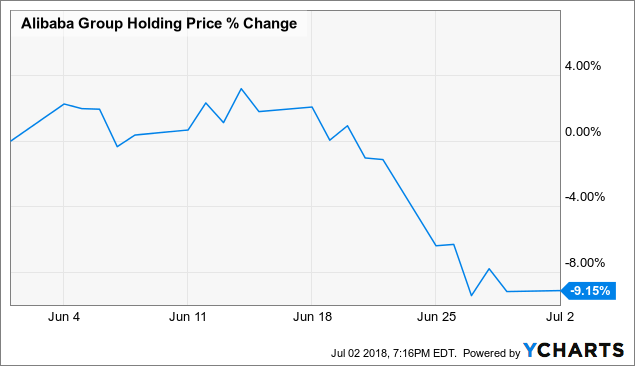

Alibaba’s flywheel and willingness to ride inevitable technology trends will continue to propel them as a strong business. With the recent pullback, the valuation doesn’t seem too bad.

BABA data by

BABA data byThe Flywheel

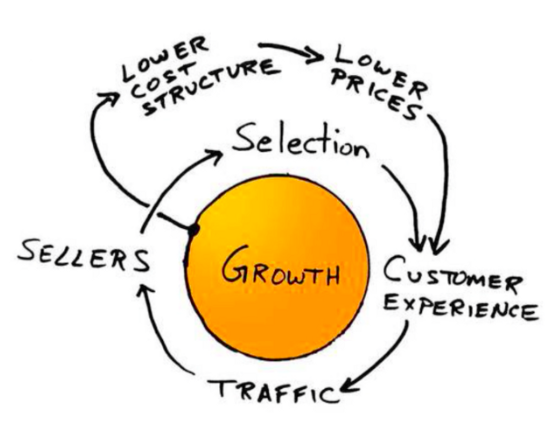

Just like Amazon (NASDAQ:AMZN), Alibaba has an incredible flywheel. A flywheel is basically a strong value proposition that reinforces itself with economies of scale and momentum.

Source: Amazon

For instance, in Amazon’s case, AWS was a result of the flywheel. All of a sudden, extra server space from the rapid expansion in its e-commerce operations, led to its rise in cloud computing. Essentially, the flywheel is the manifestation of future successes based on rapid experimentation and business growth. Then, the value proposition becomes stronger and stronger, just like a network effect.

Alibaba’s business functions very similarly. For example, its core commerce segment accounts for 83% of sales but the value proposition is so strong because it has built a great ecosystem of capabilities. Imagine you’re a consumer in China. You can peruse Taobao, Alibaba’s consumer-to-consumer marketplace for great deals on any items you need. But you can also sell goods here.

Or if you own a business, you can list items on Tmall to use Alibaba as a third-party provider. But as a small business, you can also integrate payments with Alipay, use cloud services with Alibaba Cloud, get loans from Ant Financial(which was spun off by the company, before its 2014 IPO, in 2011), and even expand your offerings internationally with Tmall Global.

The extensive capabilities strengthen the company’s value proposition, which, in turn, brings more customers to the platform. In fact, to the tune of 617 million monthly active mobile users for the retail segment alone, up 22% year over year.

The Business Model Breakdown

But just because the flywheel is similar between Amazon and Alibaba, doesn’t mean the business model is. If you only glance at the financials, you can infer that.

About half of Amazon’s retail business is through first-party selling. This means wholesalers sell to Amazon, which acts as the retailer on its own platform. The other half comes through third-party selling, which is Alibaba’s bread and butter. This means that Alibaba only acts as a vehicle by which buyers and sellers connect. Think of it as a toll booth that takes a cut of every transaction. This is partly why Amazon reports about a 4% operating margin (also because the company ceaselessly re-invests in its business) and Alibaba about a 30% EBIT margin.

What’s more is that those commissions Alibaba charges its sellers only make up about 32% of sales from core retail. The remaining 68% comes from marketing services. The company charges sellers for ad placements and priority viewership based on cost-per-clicks. It is just like Google (NASDAQ:GOOG) (NASDAQ:GOOGL) Adwords. No wonder Alibaba’s margins are high; it basically sells ads to businesses to compete for viewership so they can sell more. As a comparison, Google’s gross margin tends to hover around the mid-60%’s. And sellers must comply. Reaching 617 million eyeballs monthly is a huge advantage.

So Much Room for Activities

Just like Tencent, Alibaba has a lot going on. Besides core retail and cloud computing, the company offers media streaming with Youku Tudou, a Slack-like application called DingTalk, a Google Maps function called AutoNavi, and a food delivery service named Ele.me among other innovations. These segments make up the remaining 10% of sales, leaving 7% for the rapidly growing cloud services.

Plus, Alibaba’s 33% stake in Ant Financial is a very valuable asset as rumors have it valued around $100 billion. This is because Alipay, which is under the Ant Financial umbrella, has been a top payment provider in China. And the innovation is not stopping.

The company has been championing its “Five New” visions made up of initiatives to ride the waves of New Retail, Manufacturing, Finance, Technology and Resources (or Energy). Alibaba has been particularly keen on New Retail, envisioning a future where the integration between online and offline is seamless. In the latest quarter, income from operations dipped to the lowest as a percentage of revenue in the last couple of years. Management addressed this in the earnings call, stating that:

“the development of New Retail business will have different financial and margin impacts to core commerce over the next several years, because parts of our New Retail revenues are accounted for on gross basis, where we operate, own, and sell inventory directly. By the way, please note that this is not same as traditional buy and sell First P[arty] business, because the reason we are doing this is to figure out the ways to improve the efficiency of the whole retail value chain is for the restructure and transition of this retail field. And later on, we're going to use this methodology to enable user technology to enable the offline retailers to reform their business.”

I think this is a key quote to understand where the company is headed in the future. It seems as if it is playing a little bit of JD.com’s (NASDAQ:JD) game, foraying into the first-party space. However, at the same time, it seems like a test for better servicing customers down the road. Going full-fledged into owning inventory would be a fundamental change in the whole business so this will be an important piece of the narrative to watch.

Financials And Valuation

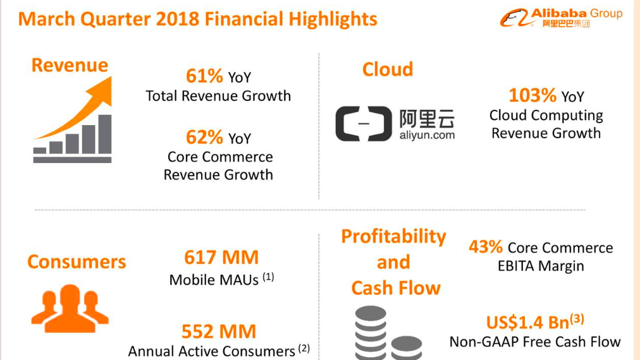

Alibaba saw its core business grow at a 62% clip last quarter to $8.2 billion. Cloud services grew 103% to $700 million, a very similar number to Nvidia’s (NASDAQ:NVDA) datacenter business. But that led to overall revenue increasing by 62% to almost $10 billion.

Source: Alibaba

Historically, operating margins have hovered around 30% but investments into logistics networks and New Retail may curtail that in the meanwhile, though Q4 is typically the biggest quarter in terms of spending.

However, the company does not expect growth rates to slow all that much. On the last call, revenue guidance for 2019 was over 50%, with multiple analysts remarking how impressed they were.

If Alibaba can beat guidance, $58 billion (52% growth) is a very plausible sales number for the end of 2019. Factoring in some investments, let’s say EBIT margins come out to 28% for the year. This leaves the company with $16 billion in EBIT. Right now, the market cap is $477 billion with an $8 billion net cash position.

So the forward valuation comes out to be about 29x forward EBIT, a very similar number to Tencent. Both companies have been able to maintain extreme profitability with huge revenue growth from big bases. It is interesting that the market is valuing them so similarly. In my opinion, both of these juggernauts are almost equally impressive, but more on that in the conclusion.

Risks

Alibaba, though a powerhouse, still has risks. Mainly, competition is stiff from JD.com. Not coincidentally, Tencent owns an 18% stake in JD and Walmart (NYSE:WMT) and Alphabet both have substantial investments in the company. Everyone is gunning for Alibaba.

As stated, Alibaba has a very asset-light business model whereas JD has a very capital-intensive one, as it owns more than 500 warehouses. Many people think that JD will, one day, have a large competitive advantage because of its iron-tight grip on its logistics infrastructure. If Alibaba were to disrupt itself and its business model to play JD’s game, profitability would suffer immensely. For instance, JD actually hauls in more revenue ($60 billion annually) but its market cap is only about $55 billion, or less than 1/8th of Alibaba’s.

No comments:

Post a Comment