Labor Paradox: As Trump Fights For Jobs The Trucking Industry Struggles With 'Yuge' Labor Shortage

Job creation has been a key focus of the Trump administration which has blamed outsourcing to lower cost countries like Mexico and China for the stagnant wages of the middle-class working folks of America's Midwest.

The only problem with that theory is that certain industries in the U.S. are actually struggling with extreme labor shortages but can't fill positions either due to skill gaps or an entitled millennial workforce that would rather live in their parents basement for the rest of their life than take a "blue collar" job that doesn't value their BA in Anthropology.

According to a recent analysis from the American Trucking Association (ATA), the OTR Truckload industry is one area where employers are expected to face a huge labor shortage of as much as 175,000 by 2024.

There are many reasons for the current driver shortage, but one of the largest factors is the relatively high average age of the existing workforce. The current average driver age in the OTR (Over-the-Road) TL (Truckload) industry is 49. In addition, the industry has historically struggled to attract all segments of the population as just 5.8% of truck drivers are women. This share has been essentially unchanged over time.In 2014, the trucking industry was short 38,000 drivers. The shortage is expected to reach nearly 48,000 by the end of 2015.If the current trend holds, the shortage may balloon to almost 175,000 by 2024.

Per the ATA, replacing retirees accounts for nearly half of the 890,000 new drivers that will need to be hired over the next 10 years.

Of course, one problem is that, like most other "main street" jobs, real annual wages for truck drivers have actually declined over the past 10-15 years.

But as Steve Viscelli, a sociologist and fellow at the University of Pennsylvania’s Robert A. Fox Leadership Program, points out, the real wage deflation for truck drivers is massively underestimated by the grueling nature of the industry's owner-operator model that consistently demands more from drivers without pay increases.

ATA largely blames the grueling demands of a job that puts workers on the road for long periods. But Steve Viscelli, a sociologist and fellow at the University of Pennsylvania’s Robert A. Fox Leadership Program, says the shortage is the product of an industry labor model that relies heavily on inexperienced drivers and independent contractors.Drivers typically receive training from big trucking companies or schools affiliated with them. Those who become independent contractors sign lease-to-own deals to purchase their vehicles, often with those same companies. But the terms are onerous, and drivers owe so much that they may end up working 70 or 80 hours a week just to pay back what they owe and cover expenses such as fuel and insurance. Drivers are suing some companies that use this model, saying they should be classified as employees rather than contractors.Even those working as employees have a hard time making ends meet, partly because they are only paid for the miles they drive, not time waiting to load and unload their rigs or sitting in traffic. Mr. Viscelli recounts a 16-hour day spent crawling through traffic in the New York area, only to get stuck at a New Jersey rail yard for the night. That day he drove 215 miles and earned $56.

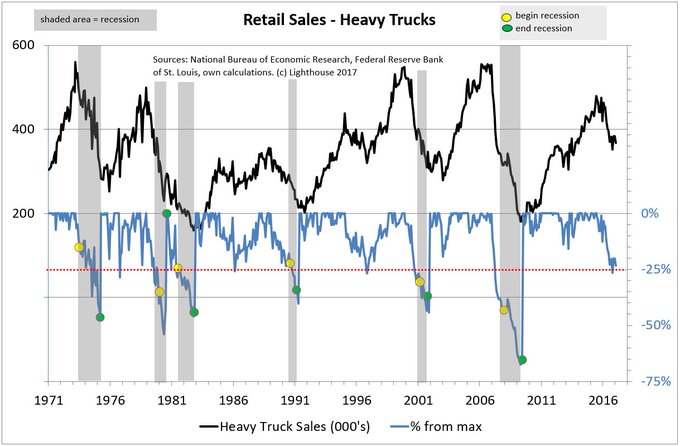

Of course, if the following chart from MacroTourist holds true then the whole driver shortage may just work itself out 'naturally' over the next couple of years.

Not many instances in past 35 years where US heavy truck sales declined >25% from previous peak and economy was not in #recession

And then there are also those pesky robot trucks...

No comments:

Post a Comment