Food Retail: A Primer On The Industry With A Focus On Wal-Mart

Summary

The food retailing industry is mature, highly competitive, and in full change.

E-commerce, organic foods, and customer experience are new trends that retailers need to address in their day-to-day business.

Some players will suffer while others will be able to adapt to this new environment.

Wal-Mart is the best positioned company to face this evolution.

Does it mean that Wal-Mart is a buy? We do not think so.

E-commerce, organic foods, and customer experience are new trends that retailers need to address in their day-to-day business.

Some players will suffer while others will be able to adapt to this new environment.

Wal-Mart is the best positioned company to face this evolution.

Does it mean that Wal-Mart is a buy? We do not think so.

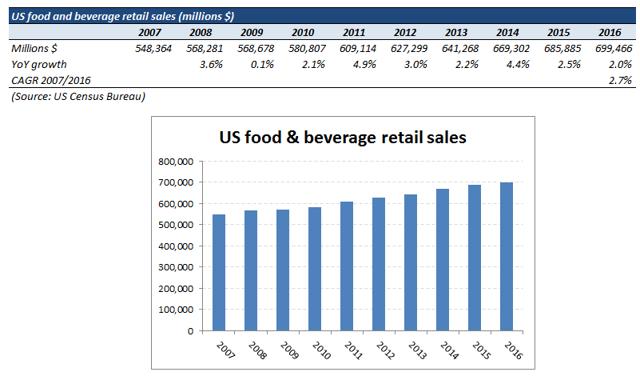

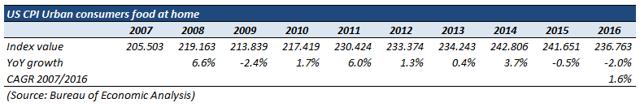

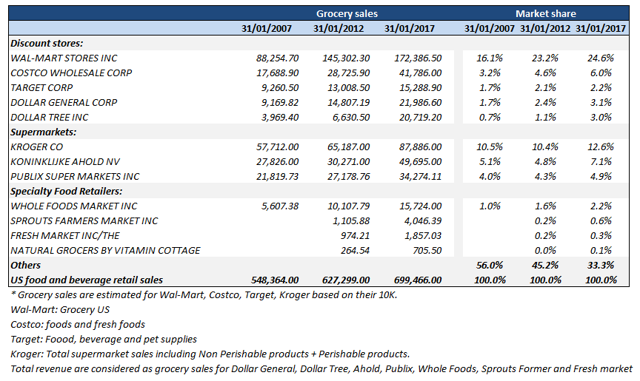

The US food retailing industry is a mature industry, accounting for roughly $700B sales in 2016. Over the period 2007/2016, total sales grew by a constant average growth rate of 2.7%, which is on line with the GDP growth rate over the same period.

Clearly, we do not expect the future long-term growth rate of the industry to exceed the GDP growth rate. Indeed, volume growth is limited because people will not buy much more quantity than they are able to eat and drink. However, they may buy more expensive foods and beverage. Therefore, the industry may benefit from pricing depending on the ability of retailers to pass through price increases to customers. Retailers might be helped by positive food inflation and improving product mix (e.g.: more organic and fresh foods) whereas competition will act as a headwind.

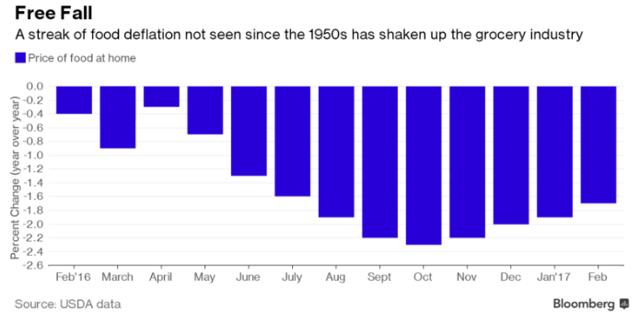

Food inflation

During prolonged period of deflation (food deflation not global deflation), retailers may try to increase market share by lowering prices to customers, sharing with them the reduction in costs. As a result, a price war may start between the different players. Positive (and moderate) inflationary environment allows boosting top line if higher prices are passed through customers. If retailers decide to compete on prices, the impact on sales and margin is manageable unless retailers become very aggressive. Historically, food inflation was positive but volatile. Unfortunately, food inflation is almost impossible to forecast, thus we cannot predict the end of the recent food deflation period, which has prompted severe competition in the industry.

Product mix

There are two important changes in the product mix for food retailers: an increasing offering of organic and fresh foods and an increasing share of sales generated online.

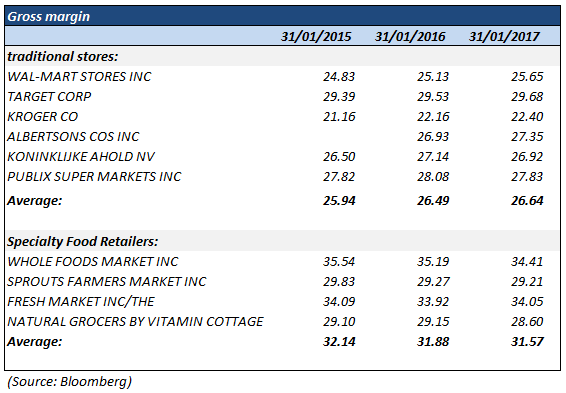

First of all, grocers have extended their offerings in organic and fresh foodsin order to meet the demand from their customers for healthier foods. Organic and fresh foods are premium products, thus they are more expensive and more profitable (see next table). This shift towards organic products may allow grocery stores to improve their product mix, their revenue growth, and their profitability. The idea has been very well understood by the different retailers as they all have increased their offerings of organic and fresh food in the past few years. However, it represents only a small part of total volume for supermarkets, thus the impact on sales and margin is still minimal.

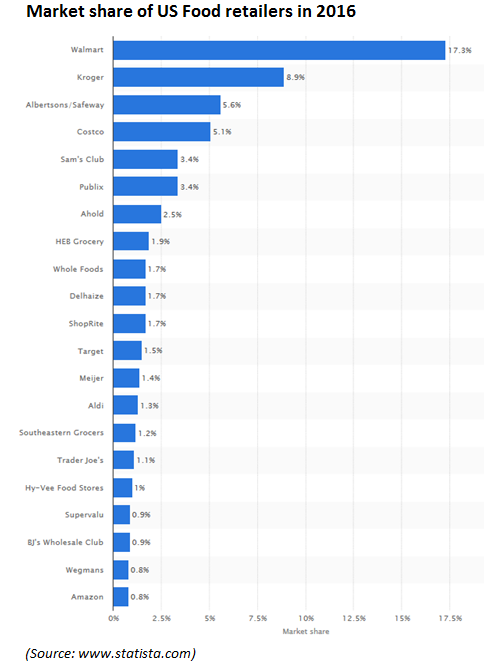

Grocery e-commerce is also a new trend with largest grocers investing a lot in order to meet clients’ demand and to remain competitive. A reportpublished by The Digitally Engaged Food Shopper estimates that around 25% of America households are buying some groceries online (up from 19% in 2014) and expect that more than 70% of them will buy groceries online within 10 years. Each grocer will be impacted in a different way by the e-commerce trend. Indeed, only the largest players (e.g.: Wal-Mart (WMT), Target (TGT), Amazon (AMZN)) will benefit from this new channel because they have the required size and infrastructures to deal with the e-commerce requirements, such as distribution network, inventory management, and IT infrastructure. As a consequence, they will probably keep gaining market share over small regional retailers. The following table shows that large grocery retailers gain market share whereas smaller regional chains are losing ground.

Please note that market shares in this table are a rough approximation of real market share given later (Chart provided by Statista) because of two reasons: First, this table tries to estimate food and beverage sales (when possible, otherwise, it considers 100% of sales as grocery sales) for the companies, and it leads to rough estimates because retailers do not split their sales with the same categories in their 10-K. Then, it is compared with US total food and beverage sales whereas the table provided by Statista uses total retailers sales (including food and non food items).

E-commerce should not increase significantly total volumes because clients will buy online what they need, instead of shopping into brick-and-mortar shops. In terms of pricing, we do not think that retailers offering online services will get a premium pricing because of the easy arbitrage between ordering online and going into the shop, which is amplified by the competition between the different players. As a result, the growth of e-commerce should weight negatively on margins because the cost of filling an e-order is more expensive (it requires additional staffs for preparing the orders as well as extra costs for delivering). Finally, one aspect often overlooked in the different articles talking about e-commerce is the reduction in “non-necessary” purchases. Indeed, I can safely bet that all of us have bought something unplanned (or unnecessary) while walking the aisle or waiting at the checkout. Online shopping will probably reduce this behavior as clients will only click on the items that they really need. Fortunately, this behavior does not represent the majority of sales; therefore, the decrease in volume will be minimal for the industry, and this could possibly be offset by data analytics showing customers an advertising that targets their hobbies or others marketing techniques. To sum up, we think that e-commerce will not affect overall volume for the industry and will benefit largest players, able to gain market shares, and that total earnings will go down due to extra-costs for delivering orders.

Competition

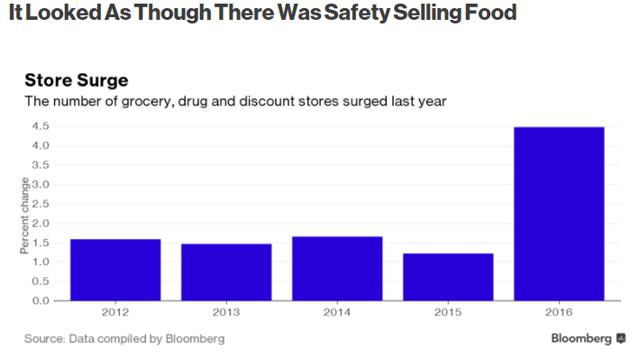

Retailers sell the same undifferentiated products; therefore, they can only compete on price. Competition has been tough in the last few years and should continue for the following reasons:

1) New competitors like the hard discounters Lidl and Aldi want to expand into the US, and Amazon wants to diversify its activities into the grocery business with the acquisition of Whole Foods (NASDAQ:WFM) Market.

2) Existing players are still increasing the number of shops in already high penetrated markets. For example, between 2015 and 2016, Dollar General (DG), Wal-Mart, and Dollar Tree (DLTR) have opened respectively 837, 289, and 483 shops in the US.

3) All major traditional players are investing significantly (internally and externally) in e-commerce capabilities. Here is a list of recent acquisitions:

| Acquirer | Acquired | Business |

| Kroger | YouTechnology | A digital coupon platform |

| Kroger | Vitacost | An online health products retailer |

| Wal-Mart | Jet.com | An e-commerce company |

| Wal-Mart | ShoeBuy | An online footwear store |

| Wal-Mart | ModCloth | An online women’s fashion retailer |

| Wal-Mart | Moosejaw | An online outdoor retailer |

| Wal-Mart | JD.com (alliance) | A Chinese e-commerce website |

| Amazon | Whole Foods Market | Natural food supermarkets |

| Kroger | Vitacost.com | Online retailer of vitamins and supplements |

| Target | Grand Junction | Software company operating in supply chains |

4) They all propose promotions and loyalty programs offering more and more discount and cash back in order to gain market shares.

The other aspect of competition is customer experience, but we think that this is not the main differentiator, especially because all retailers offer equivalent services. As a consequence, market share gain will probably not be sustainable as direct competitors will fight back with aggressive pricing campaign in order to regain market shares.

Industry conclusion

The food retailing industry is mature and highly penetrated in the US, offering muted volume growth. Mix product improvement and price will be the major driver of growth instead of volume. In terms of price, food deflation and competition are still a concern. Indeed, the development of fresh and organic food is positive for the industry while the e-commerce trend is positive in terms of volume only for the largest retailers to the detriment of regional chains (but still negative in terms of profitability). Finally, the most worrisome aspect to consider is the degree of competition with the development of hard discounters, the opening of stores in already highly penetrated markets, and the competition of pure-online players.

Given the industry characteristics, we think that the best-positioned company should have sizeable operations and a cost advantage. The large size allows to increase bargaining power with suppliers, to spread the fixed costs required for e-commerce development over millions of clients (thus reducing the cost per customer), and to have a large distribution network, which will be the foundation of e-commerce business (home delivery, store pick-up). The industry sells undifferentiated products to the largest part of the population (the middle class), thus a differentiation strategy makes no real sense whereas a low cost strategy makes sense because it allows the company to gain market share via attractive pricing and to maintain it over time.

Wal-Mart: Company overview

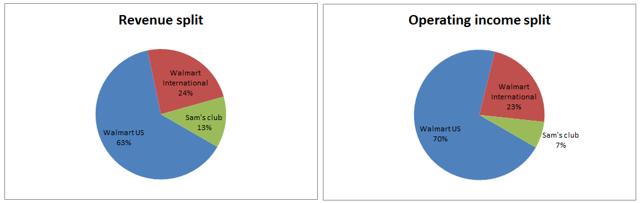

Wal-Mart is the world’s largest retailer. The company serves more than 260M customers per week, generates more than $482B in revenue across its 11,695 stores spread out in 28 countries and its e-commerce websites operated in 11 countries. The group operates three business segments: Wal-Mart US, Wal-Mart International, and Sam’s club.

Wal-Mart US incorporates all the retail activities operated in the US, including the business realized in brick-and-mortar shops as well as e-commerce sales. Wal-Mart International incorporates all the retail activities operated outside the US. Sam’s club is a warehouse club operated in the US. Customers have to pay a membership fee in order to get access to the warehouses.

Revenue and operating income are distributed as follows:

The strategy of the group has always been focused on price leadership and assortment. However, the competitive environment and the development of e-commerce have marginally modified their way of doing business. Indeed, from now on, not only they want to lead on price and assortment but also they want to differentiate on access and customer experience.

It seems that Wal-Mart provides all the characteristics that we are looking for.Indeed, Wal-Mart has sizeable operations and price leadership. Moreover, the group has implemented its e-commerce initiatives for several years and has a strong presence in rural markets, (way above its direct competitors) which provide market share stability because e-commerce will be less disruptive there. Finally, its e-commerce offering might allow Wal-Mart to gain market share in high population density locations where the group is underpenetrated.

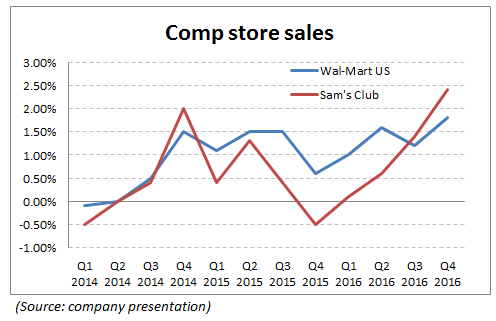

Looking backwards

Operating income has decreased over the last couple of years despite some positive revenue growth. Wal-Mart has taken different initiatives in order to develop its e-commerce capabilities and to reinforce the attractiveness of its shops. Moreover, the group has also invested in commercial initiatives (discounts and prices) in order to gain or maintain market shares versus new competitors like Amazon, Lidl, and Aldi. As a consequence, top-line growth should improve as soon as these investments start to pay off. Indeed, the company has only introduced its two-day free shipping on January 2017 and the pickup discount on April 2017. These services should gain traction over time and support top-line growth. Same-store sales growth will be the key indicator to monitor over the coming months in order to gauge the initiatives implemented by the management.

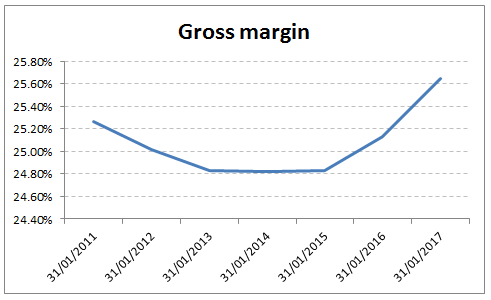

Wal-Mart has demonstrated its bargaining power with its suppliers by increasing its gross margin over the last two years despite price investments.

Looking forward

These investments were done in order to remain competitive in a challenging market. One key idea previously developed is that market share losses for one player will probably lead to aggressive pricing campaigns in order to recover the drop in revenue. Such strategy is value destructive for each single competitor, unless they have a lower cost structure enabling a sustainable competitive advantage.

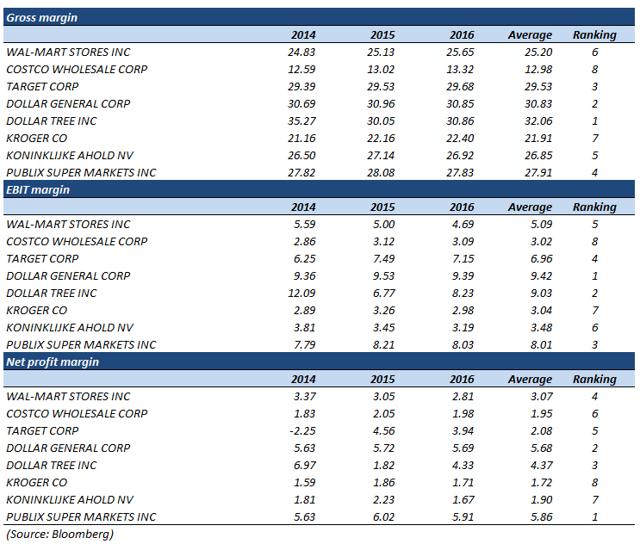

Surprisingly, Wal-Mart ranks only sixth in terms of gross margin despite its supposed bargaining power with suppliers. A lower selling price versus its competitors might be an explanation. However, Dollar General and Dollar Tree, which are very aggressive in terms of pricing, have better margins. That can probably be explained because of the product offerings. Indeed, they offer fewer references and focus only on items that they can buy at very attractive prices.

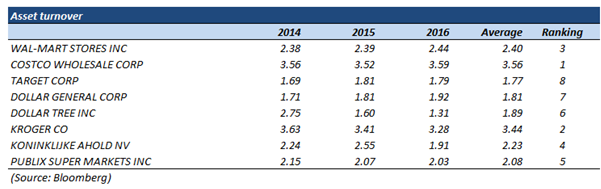

Wal-Mart’s asset turnover is higher than all its peers, having higher gross margins, an indication that the group has probably lower prices but is able to sell more, thanks to its pricing advantage.

In terms of operations, Wal-Mart screens better when measured in terms of EBIT margin or net profit margin, being right around the middle of the peer group. One caveat: two of the three companies outperforming Wal-Mart on margins are discount store chains, offering $1-priced items. Therefore, they are not real peers despite being in the same industry. We can conclude saying that Wal-Mart is the second most profitable supermarket (behind Publix which is not listed).

Wal-Mart also has the advantage of being less exposed to high densityareas and more exposed to rural areas. This allows Wal-Mart to feel comfortable about e-commerce disruption because the low population density makes home delivery less profitable. It also offers Wal-Mart an opportunity because its e-commerce capabilities could allow gaining market share in urban locations with high density population where it is under-penetrated. According to a report by Goldman Sachs, 53% of Wal-Mart’s stores are located in the top 100 MSAs (Metropolitan Statistical Areas) whereas, respectively, 77% and 79% of Target’s and Costco’s (NASDAQ:COST) shops are located in this area.

International

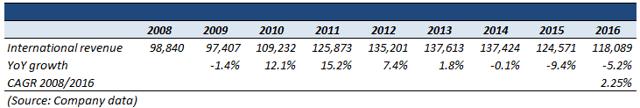

Until now, the discussion has been around the US franchise, but Wal-Mart operates also an international business.

Indeed, Wal-Mart is present in numerous countries, including China, Argentina, Brazil, Canada, Japan, Mexico, and in the UK. Most of these countries offer compelling growth opportunities, because their economies are growing quite rapidly, and the retail food industry is still underpenetrated.

However, the group has struggled in the last few years in its main foreign operations: macroeconomic was a real challenge in Brazil, the UK became even more competitive with the rise of discounters, and the group fails to understand Chinese customers because of cultural differences. Finally, the appreciation of the US dollar has also acted as a headwind. All in all, foreign operations should be the growth driver of the group over time despite period of volatility across some regions.

Valuation

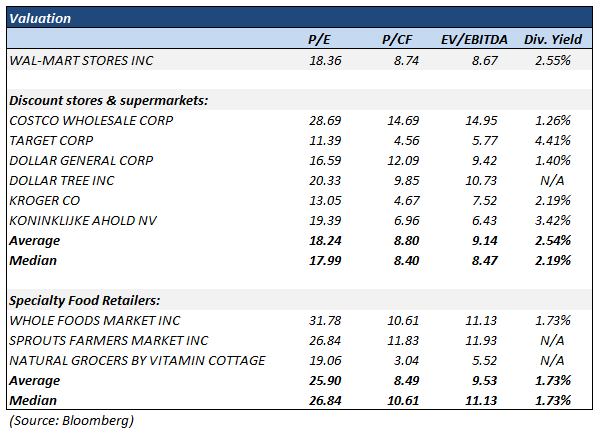

At first glance, Wal-Mart does not trade at a discount to its peers (we consider traditional supermarkets as well as discounters). We have excluded specialty food retailers from direct peers because their growth prospects are better due to a lower penetration rate of organic and fresh foods and higher awareness of healthier foods among consumers.

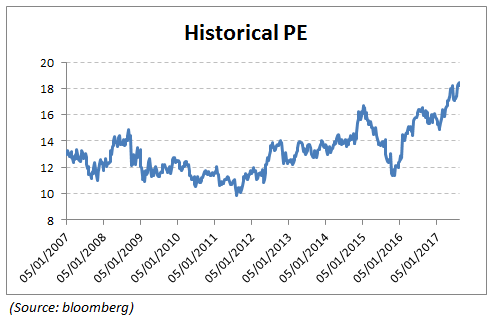

At the same time, historical data show that Wal-Mart is expensive (and the staples in general). Of course, low interest rates were a major driver for multiple expansion, but we are at a turning point with the Fed starting to hike rates. Moreover, we have the feeling that the competition is stronger than before and that margins are further under pressure than in the past at a moment where valuation is at peak.

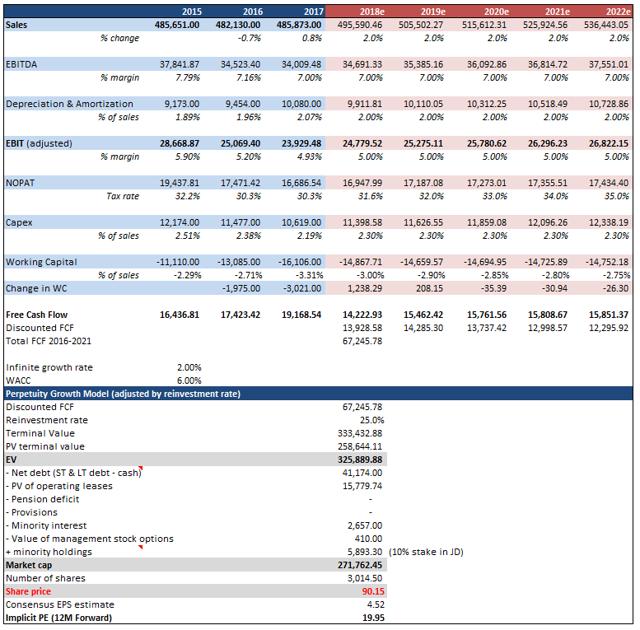

Finally, a DCF is necessary to gauge the opportunity of investing in Wal-Mart. We have made the following assumptions:

- Top-line growth of 2%, which is a blue sky scenario, given the challenging market and the lack of food inflation.

We can break down the topline growth as follows:

(+) Modest food inflation

(-) Price competition (Competitive industry and new competitors and e-commerce)

(+) Market shares gain

(+/-) mix product (organic and fresh foods and e-commerce)

(+) Volume growth if the retailer is exposed to emerging markets

- EBIT margin (adjusted for operating leases) of 5%, rather optimistic since they might further fall because of the growing share of e-commerce and price competition.

- Depreciation and amortization and capex are in line with the average of the three previous years.

- WACC (Cost of Capital) is at 6% (which is very low) and the terminal growth rate is 2%.

- ROIC (Return on Invested Capital) is set at 8% forever, which implies a 25% reinvestment rate.

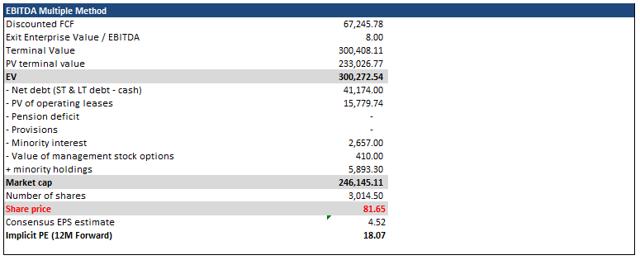

The average of the two methods results in an $86 target price that represents a potential of appreciation of 6% (based on a $81 stock price). This target price relies on a very positive scenario (back to growth without negative impact on margin and very low cost of capital); therefore, we can consider it as a ceiling.

Conclusion

Wal-Mart has the required strengths to keep its leadership in the retail industry. Indeed, the group is large enough to invest in the e-commerce and has a diversified footprint in rural areas, which is less sensible to the threats of home delivery, e-commerce, and competition, in general. The group is also among the most profitable due to a very sophisticated supply chain management, strong bargaining power, and a lower tax rate. As a consequence, the group has the possibility to maintain and even to gain market share during periods of price wars. However, the mix change towards e-commerce will weight negatively on profitability and will put further emphasis on pricing, which is never a positive thing.

Even though we acknowledge all the positive characteristics of the company, the investment comes at a price that we consider to be not attractive. Indeed, the stock trades in line with its peers, and the PE ratio is trading way beyond its historical range despite a more challenging environment and muted EPS growth (guidance is for low-single digit growth, and a large part of it will be driven by share buyback). Finally, even in a benign scenario, a DCF model values the stock roughly in line with the current price.

No comments:

Post a Comment