The Food System of China: The Real Story

FEATURES - COVER STORY

Training and managing suppliers from farm to factory enable a manufacturer to maintain its food quality, while helping to build the quality of the entire Chinese food system.

LISA LUPO | December 11, 2014

There’s hardly a day that goes by that there isn’t an Internet news item about food from China, whether it’s a breaking story or opinion piece on a food safety incident or analysis of the current state of the country’s food system. But, as with much of the coverage of the U.S. food industry as well, it can be difficult to differentiate fact from hype. To get the real story, QA Editor Lisa Lupo spoke with top executives from various segments of the food industry. Together, these experts have more than 70 years of experience in conducting business in or with China.

There’s hardly a day that goes by that there isn’t an Internet news item about food from China, whether it’s a breaking story or opinion piece on a food safety incident or analysis of the current state of the country’s food system. But, as with much of the coverage of the U.S. food industry as well, it can be difficult to differentiate fact from hype. To get the real story, QA Editor Lisa Lupo spoke with top executives from various segments of the food industry. Together, these experts have more than 70 years of experience in conducting business in or with China.

Included in this section are insights from Yves Rey, Danone corporate quality general manager and former GFSI president; David Acheson, founder of The Acheson Group and former FDA associate commissioner for foods; Roger Lawrence, McCormick & Co. corporate vice president, global quality assurance and regulatory; and Bradd Eldridge, founder of Quality Management Partners, with previous positions with leading companies in global quality assurance. Also featured in this section are a focus on Nestle’s National Food Safety Institute in Beijing; insights from Linhai Wu, lead author of Food Safety in China: A Comprehensive Review; and perspectives from GIE Media’s Brian Taylor who has been living and working in Hong Kong for two years.

The food system of China is distinctly different than those of the Western world. These differences, and the associated challenges of both food safety and conducting business, are primarily factors of three key areas: China’s government system, the unique culture of its people, and its supply chain rooted in family farms.

China’s Evolving Food System.

China is not an easy place to conduct business; it has long had challenges in producing safe, quality food. However, improvements are being seen, driven by the government’s goal to be #1 in food exports, by the foreign businesses setting up facilities in the country, and by the media and the people of China themselves. Additionally, if you take the time to understand the country and its people and heed the recommendations of those who’ve been there, the opportunities of this country—the most populated in the world—are vast. Currently:

- China produces about 20% of the world’s food—in only 9% of the world’s sown area.

- It produces 18% of the world’s cereal grains, 29% of its meat, and 50% of its vegetables.

- The country has the world’s largest agricultural economy, and ranks as the largest global producer of pork, wheat, rice, tea, cotton, and fish.

- The value of China’s agricultural output is that of the U.S.

- The country is currently the fifth largest exporter and fourth largest importer in the world.

(Source: Colin A. Carter. “China’s Agriculture: Achievements and Challenges.” Agricultural and Resource Economics Update 14(5)(2011):5-7)

According to many of the experts cited in this article, China’s goal is to become the top food producer in the world. “Food is the foundation of their economy, and food safety and quality really are top of mind in China,” Rey said. This is, in part, because of the need to feed its immense population, but it also is critical in building its reputation as a food exporter, as well as the fact that China’s people are becoming more vocal and demanding that local foods also be of high quality. “It’s a matter of stability,” Rey said. “The best way to keep a country at rest is to keep the people happy.”

This cry of the people does seem to be having impact as well. As Lawrence said, “I have seen a vast improvement in supply of materials and recognition that products for a developing export market require a different standard—and that has led people to question, ‘Why would we have a different set of quality standards? Doesn’t the Chinese consumer deserve the same degree of quality?’”

This cry of the people does seem to be having impact as well. As Lawrence said, “I have seen a vast improvement in supply of materials and recognition that products for a developing export market require a different standard—and that has led people to question, ‘Why would we have a different set of quality standards? Doesn’t the Chinese consumer deserve the same degree of quality?’”

This has, then, raised the bar for local producers as well, Lawrence said.

“The Chinese government has become far more aware that it can’t march to the beat of a different drummer in food safety and food quality than the rest of the world—and have an impact,” he added.

In fact, Reuters recently wrote that China’s Premier Li Keqiang was quoted by state radio as saying that China’s economy must sustain mid- to high-level economic growth, and manufacturers must be encouraged to move up the value chain.

It was on this topic that Rey met with the Premier in October. The country’s strategy is to move from quick production with a goal of supplying the people’s needs to quality production to improve the quality of life and the environment, Rey said. China still needs to meet its people’s needs, but “now is the time to be quick and good as well.” To do so, the country is shifting its label verbiage from “made in China” to “created in China” with a focus on innovation, Rey said, adding that he was then told, “As a global company, you should support our strategy.”

Food Safety in China

An Evaluation of Consumer Complaints

In the U.S., consumer trends, purchases, and complaints have a significant impact on the food processing industry and its products. Although consumers had little voice in the past in China, this, too, is changing with the growth of the middle class and the growing independence of the media. In the book, Food Safety in China: A Comprehensive Review (CRC Press, 2015), authors Linhai Wu and Dian Zhu derived consumer satisfaction ratings of various food safety aspects, based on a survey of 4,289 consumers of 19 provinces, along with analyses of survey results of consumer food safety evaluation and investigated issues related to consumer food complaints based on 2007-2011 data published by the China Consumers’ Association (CCA). Among the key findings were:

According to the authors’ analysis, the major food safety problem complaints included incomplete information of labeling, unauthorized alterations of production date, inclusion of foreign bodies, use of inferior materials, excessive use of food additives and sweeteners, use of chemical additives not intended for food processing, illegal use of chemical substances outside the usable range specified by food regulations, improper control of pathogenic microorganisms, excessive chemical fertilizer and pesticide residues, heavy metal and other harmful substances in agriculture products, and illegal use of antibiotics, hormones and other harmful substances.

It also must be noted, however, that China’s food safety supervision system underwent a major reform in March 2013, through which it became the responsibility of food and drug regulatory authorities to supervise food safety in circulation. However, the authors state, “the reform does not mean the resolution of problems in food safety supervision in circulation. The problems still exist objectively, and the food and drug regulatory authorities have to undertake these long-term and arduous tasks.”

About the Book. Food Safety in China: A Comprehensive Review chronicles China’s current food safety problems from a professional perspective. With investigative research and an authoritative analysis of the subject, the book considers the complex issues that span the entire food supply chain system in China, and investigates the changing track of food safety in key stages, such as production, circulation, and consumption. Topics of the book include food production and processing; food transportation; food consumption; environment and consumer awareness of food safety; efforts and technical means of the government in food regulation; social responsibility of food producers and traders rationality, effectiveness, and operability of the technical specifications in production, processing, circulation, and consumption. Food Safety in China is available from the QA Bookstore. About the Book. Food Safety in China: A Comprehensive Review chronicles China’s current food safety problems from a professional perspective. With investigative research and an authoritative analysis of the subject, the book considers the complex issues that span the entire food supply chain system in China, and investigates the changing track of food safety in key stages, such as production, circulation, and consumption. Topics of the book include food production and processing; food transportation; food consumption; environment and consumer awareness of food safety; efforts and technical means of the government in food regulation; social responsibility of food producers and traders rationality, effectiveness, and operability of the technical specifications in production, processing, circulation, and consumption. Food Safety in China is available from the QA Bookstore. |

China’s Government System.

Such shifts in focus or even regulation are not uncommon, and, as such, one challenge of operating in China is the speed at which the government can enact new rules. Just because a business met all the regulations yesterday doesn’t mean that it meets them today. Unlike the U.S. where food legislation must follow a strict process with time allowed for stakeholder input, China has no such requirements, so can— and does—set new regulation(s) virtually overnight, with penalties immediately enforced. For this reason, it is important that businesses build private/public partnerships, Rey said. On the positive side, this is fairly easy to do in China because the government understands the need as well. Because China can supply only 70 percent of the food needed by its people, it needs outside suppliers.

While the government is working to improve this focus, implementing new regulation, such as the recent proposed revision to its Food Safety Law, there is a question as to how deep the effort really goes, Eldridge said. “China wants to drive and improve its image and quality, but it has a ways to go.” Even within the government, there is a great deal of fragmentation. Food businesses are regulated by the national government (and must be approved to even begin operation), but they are also under the auspices of each separate province—with separate being a key word. “The lack of consistency drives one of the greatest challenges” for companies conducting business in China, he said. The regulatory inconsistencies occur not only between provinces, but also between a province and the national government; at times, national regulations are stricter, then, at other times, a business may follow all the national requirements only to find it isn’t meeting even stricter provincial rules.

In some ways, however, “it’s not that different from the thought process we have—it’s just more complex,” Acheson said. As a former FDA official, he has interacted directly with officials of the Chinese government and seen a great deal of change over the years both within the government and between the government and its people.

In the Past ...

In 2007, Acheson met with Chinese officials to discuss issues of food and other products being exported to the U.S. from China. But rather than focusing on the production or product safety, Acheson was told, “If you could only control your media and get Congress under control, we wouldn’t have a problem.” At that time, they saw food safety as simply a matter of brand management; they were more concerned with the impact on China’s economy than on the quality of the products. There was a definite disconnect at that meeting with China focused on ensuring that its exports didn’t stop and the U.S. focused on the safety of its imports, Acheson said.

Not long after that, in 2008, Acheson was speaking with Chinese regulators following the melamine contamination of infant formula. He asked the officials to explain how China regulates its food processes—from the farm through distribution, processing, and retail. “They couldn’t tell us,” Acheson said. “Our system isn’t great, but they couldn’t even tell us what theirs was.”

Such issues and incidents have since led to hefty changes, Acheson said, driving the country to raise the importance of food safety, write food safety standards, and reorganize and change the structure of its processes. However, he added, “it’s still a work in process.”

China’s Product Control.

One area that remains significantly different than that to which Western food systems are evolving is China’s reactive vs. preventive perspective on food safety and quality.

One particular practice that illustrates this is its verification of food safety through product control or “positive release.” In much of the Western world, we depend on the food safety system and process controls to produce safe food, with testing early and throughout the process for validation. In China, there is little concern about the means by which the food is produced and processed, it simply is supposed to meet quality standards at the end. Thus, the focus is on the end product rather than on the process. When inspection occurs, it is done at the end of the line on the final product. If the quality of the product is considered acceptable, the product is passed. While this may seem to be a valid measurement, the fact is that it is impossible to test or sample every product, so there is that much more potential for unsafe foods to make it to market.

Perhaps the government feels that the quality is better controlled by severe penalties, which are considerably harsher in China—with adulteration seen as a capital offense. “If you kill someone with food poisoning, you can go to jail for a long time or be executed,” Acheson said. But he added, “Does this really act as a reasonable deterrent? I’m not sure it does.” This is because it is often more an aspect of the Chinese system, culture, and lack of preventive measures. In many instances the Chinese just don’t see things the same way we do. Excepting the cases of economic adulteration, “they’re not usually trying to get away with something,” Acheson said “it is more about just being different.”

Nestlé Opens Food Safety Research Center in China

In March, Nestlé opened a food safety research center in Beijing to help meet China’s growing demand for healthy, safe food. Following is a Q&A with Nestlé on the development, purpose, and industry benefits of the Nestle Food Safety Institute (NFSI).

1. When was the initiative begun, and what was the primary impetus?

The decision to set up NFSI was made in mid-2013. We inaugurated our institute in March 2014. While our food safety expertise is globally distributed, we recognized the need to make better use of it in Asia. We see collaboration opportunities notably in China and decided to put in place a local team that leverages our expertise for food safety matters relevant to China. Nestlé has nearly 150 years of experience with more than a billion consumers who trust and consume its products around the world. Thus, we see the opportunity for Nestlé to leverage our strong science and research to support China to address questions of food safety and quality.

2. What is the chief purpose of the Institute?

We want to leverage our global expertise on food safety for collaborations in China:

3. What benefits do you see the Institute as providing to your company, China, and the food industry as a whole?

4. What other R&D projects are being conducted at the Institute?

We currently establish research on alternative (rapid and robust) testing methods to detect economically motivated adulteration. We also investigate high-resolution screening technology for contaminant detection in raw materials. Beyond this, housed in Beijing is the R&D Center for China which, together with three other R&D Centers in Shanghai, Dongguan, and Xiamen, are responsible for delivering innovation to Nestlé China and to their respective regions. |

China’s Supply Chain.

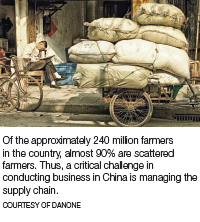

The reactive nature of the Chinese system also is of particular concern because of the country’s fragmented supply chain—one of the greatest challenges of food production in China, particularly in relation to the origination of all food: the farm. “Families are the major units for the production and sale of primary edible agricultural products in China,” said Wu in Food Safety in China. Citing the 2011 China Statistical Yearbook, he noted that there were about 240 million farmers in the country, 89% of which were scattered farmers. Of these, only about 12% (29 million) were part of a cooperative, leaving the vast majority of crops for food production to be sourced from small family farms averaging 12 acres per household. Thus, small private farmers compose the main body of agricultural production in China.

Although the overall level of food quality and safety is improving, Wu noted, “This small-scale, decentralized, and disordered pattern has become a serious problem. A considerable proportion of operators involved in food circulation lacks the necessary equipment, facilities, and standardized management, and thus does not meet the basic requirements for transacting food business.” The main problems he sees as existing in food quality and safety supervision in circulation in China are the complexity of the food supply chain and the fact that the majority of operators in the supply chain are small- and medium-sized business, with the number of these businesses continuing to grow rapidly.

As of 2011, 90% of the operators were individual businesses. “The increase in the number and proportion of individual businesses makes it more difficult to supervise food quality and safety in circulation,” he stated.

As of 2011, 90% of the operators were individual businesses. “The increase in the number and proportion of individual businesses makes it more difficult to supervise food quality and safety in circulation,” he stated.

Thus, a critical challenge in conducting business in China is managing the supply chain. You have to carefully manage all suppliers—primary, secondary, and tertiary—and have more sensitivity to what happens on the farm, Lawrence said. “It all, ultimately, goes back to the farm—whether animal or plant.”

This was a lesson that Lawrence learned in his years of working with and in China. “When we started, it was one step back tracing, and we had a rigid food safety plan in our plants. We qualified our food safety system and expected that we could have the same expectations of our suppliers. That’s not the case.” For example, he said, a tertiary supplier may substitute a non-approved ingredient to cut costs without realizing or considering the impact on the end product. If you don’t have oversight of these suppliers as well, your product—and brand—is being put at risk.

Economic adulteration, foreign material, and microbiological concerns are the greatest issues of supply from the farm in China. Much of the problem is due to lack of knowledge and training in good practices, along with the cultural psyche of cost cutting and good-enough quality. Historically, counterfeit products and knockoffs have been culturally accepted; although this is changing, the general thinking is, if you get away with it, then there’s no problem. The lesson learned is that you need to be proactive and have an effective strategy to prevent such incidents. Although there has been improvement in some areas through the years, Lawrence said, it is necessary that you are involved with and have personal oversight of all your suppliers, your suppliers’ suppliers, and so on. (See Decades of Lessons Learned, at the bottom, for more from Lawrence.)

Risk Assessment.

When working with local suppliers, Acheson said, one question a business should ask itself is, “What risks do I need to consider that I wouldn’t have to in the U.S.?” Then determine how to discern if a supplier poses that risk. The means of doing so are similar to those you would conduct in the U.S., except that, in general, they are less reliable. For example, you can:

- Handle it through a combination of reputational audits. … But, in China, many of these are questionable at best.

- Request certification. … There are a lot of companies that will issue certificates, but even Chinese nationals have said, “We get certificates, but we don’t trust them; and if we don’t trust our own, the U.S. shouldn’t either.”

- Test for contaminants. … Though reactive rather than preventive, conducting your own testing on incoming supplies is probably one of the most critical aspects of ensuring the safety of your food. But there are limitations. Beyond the inability to sample every item is the fact that testing in China is not always to the levels or with the same recovery as that expected by U.S. companies, Eldridge said. This not only can lead to a contaminant not being detected, it also can result in false positives, “so you end up working through issues that really aren’t issues,” he said. Additionally, it can be extremely difficult to test for unknown ingredients that may have been added as an economic adulterant.

- Train and educate your suppliers.

Supplier Training. “One of our main challenges is getting local supplies that can meet our requirements,” Rey said. “So we have a plan for that … We train and manage our suppliers from farm to factory.” And in China, this is not simply a best practice, it is an expectation of the government, and it is driven, at least in part, by government mandates on local purchase. That is, food and beverage manufacturers that operate in the country must source at least 50% of some products (such as dairy) from local farms. Thus, if the local farms or other suppliers do not meet a corporation’s requirements, it becomes that company’s responsibility to train them to do so.

Not only, then, does this enable the corporation to maintain its quality, it builds the quality of the entire Chinese food system. The country is quite open to applying best practices from the Western world, but it sees the integration of that as being the responsibility of the corporations that wish to do business there.

China’s Cultural Influence.

While much of what has been discussed in this special section includes at least indirect consideration of the differing culture of the Chinese, there also are some cultural aspects that have very direct influence on successfully conducting business in China. “For American companies, the culture of China is fundamentally different,” Acheson said. “There are things that are acceptable there that aren’t acceptable here.” A few of the most evident are:

- Concept of time. “In our culture, time is money. In China it’s not,” Rey said. Setting up deals takes time and they don’t want to lose face. “Make it a win/win. Do what you need to do to achieve that—be open-minded and respect them. If you make them upset, it will be risky for you; they have the time to kick you out.”

- Style of cooking. At least one of the reasons that China does not have the emphasis on and testing for Salmonella, Listeria, E. coli, and other such pathogens as does the Western world is because the style of cooking of its people is more likely to negate the effects. That is, traditionally, food has been bought and served fresher and cooked more thoroughly, with less consumption of ready-to-eat foods.

- Food availability. There is no “three-second rule” in China. If a person is cooking a meal at home and something falls on the floor, it is picked up and used. If it is past its sell-by date, the date is ignored. Because food has traditionally not been as plentiful in China, waste is not tolerated, or as accepted, as it is in the U.S. And these same attitudes and practices can carry over into the food plant.

- Lack of employee empowerment. In China, challenging a manager or even asking questions or submitting an idea can cause a person to be fired, so workers don’t, but simply do as directed. Thus, “the level of competence in a facility is aligned with the level of the top manager,” Rey said. “Developing a food safety culture is not easy because you can’t go through the people. If the manager doesn’t support it, it won’t happen.” However, he added, this is beginning to change as a new generation joins the workforce—a generation that is university-educated, is more Westernized, and brings new expertise.

So, how do you overcome the cultural differences? “We learned to adapt to their culture without changing our core values,” Rey said.

Economically Motivated Adulteration

The 4 A’s of Prevention

Food defense can include any type of intentional adulteration at any point in the supply chain, including economically motivated adulteration (EMA). Because it is motivated by profit and gain rather than intention to cause harm, there is some controversy over whether it should be considered a part of food defense or be its own category. Either way, a similar program can be developed for prevention, based on assessing and protecting vulnerabilities, said Don Hsieh, Tyco International director of commercial and industrial marketing. Unlike traditional food defense which focuses primarily on the facility site, EMA defense must have as much—or more—focus on the supply chain. But like a traditional food defense program, Hsieh said, EMA can be based on four A’s:

EMA is a criminal activity that has occurred for thousands of years, Hsieh said. “You need to look at it as preventing crime. Put in as many obstacles as you can so you are not impacted.”

|

Boots on the ground.

One of the greatest lessons learned by the experts consulted was the necessity to have “boots on the ground” while also employing Chinese nationals in management. To successfully implement your company’s requirements and best practices, you need to have managers in China who have been with your company, understand its culture and needs, and can enforce best practices … while working with the people of China and their culture.

But that is unlikely to lead to success unless you also build a strong connection with government officials—who still hold the ultimate control—to develop trust. To effect this, Eldridge said, “We moved toward Chinese nationals. We tried first with our own people, and still use some of our own people. But we found that, in an attempt to become more seamlessly integrated into their system, we needed to bring their people onto our team.”

A Global Power.

“Many companies are focusing on China because there is so much room for growth,” Rey said. The country is already number one in food production; now its continuing improvement in quality is likely to lead to global growth, which is positive and refreshing, but also a bit scary, he said.

In many ways, China’s potential for growth is less restricted than that of many in the Western world because it doesn’t face the issues of limited money and resources. Federal regulators in the U.S. and Europe have had to deal with numerous budget cuts and reduced personnel. The Chinese government doesn’t have to deal with these limitations, and even in business, capital expenditures are rarely an issue, Rey said.

But the crusade for improvement in the food safety and quality of this progressing country is being driven as much by its people as by its government’s export goals. Not only is the younger generation bringing new, Westernized ideals, but the increased influence and wealth of the growing middle class is carrying with it demands for improved food safety and quality—of food that stays in the country as well as its exports.

Then you have the media. With the worldwide availability of the web, no longer does the Chinese government hold the media under its control. “We’re now in a situation where China’s media is its biggest threat,” Acheson said. It is a “big, big change” and one that is forcing the country to face and correct issues of food safety and quality and look to playing the game the Western way.

The author is Editor of QA magazine. She can be reached at llupo@gie.net.

Decades of Lessons Learned in China

With decades of experience in doing business in China, Roger Lawrence, McCormick & Co. corporate vice president, global quality assurance and regulatory, shares 15 strategies and lessons learned through the years. But if you take home only one lesson, it should be the one upon which all the rest are based: The more remote the supply chain becomes, the more you need to make certain your quality and food safety standards are being met. Trust, but verify.

With decades of experience in doing business in China, Roger Lawrence, McCormick & Co. corporate vice president, global quality assurance and regulatory, shares 15 strategies and lessons learned through the years. But if you take home only one lesson, it should be the one upon which all the rest are based: The more remote the supply chain becomes, the more you need to make certain your quality and food safety standards are being met. Trust, but verify.- Realize the cultural differences. There are differences, and they impact the business world. You must guard against cost cutting, shortcuts, and loose adherence to standards when the benefits of adherence are not readily apparent. Such practices are ingrained, but they are changing.

- Understand the country has a different perspective on purchasing with a key focus on cost reduction by means we don’t necessarily see as acceptable. You can put out a policy, but you have to have oversight to ensure employees do it—particularly those of tertiary suppliers.

- Align company ethics. The difference in ethics is not devious; it is simply a difference in culture and a lack of understanding of our standards and processes.

- Invest in supplier development and collaboration. Evaluate what you need to do in the supply chain to ensure your food safety and quality standards are met.

- Educate suppliers in “developed-country” standards of quality and food safety. With most supply originating on small family farms, the people are so far removed from the actual manufacturing that they don’t understand the standards. It is changing, but is still decades behind in some areas.

- Understand the trade-offs between the economies realized and the risks and costs associated with off-shore sourcing. Although there are certain savings, you need to realize that money will need to be spent in training, education, and development of standards. Understand the investment you will have to make to get safe, quality food—and not put your brand at risk.

- Have an in-country purchasing and quality assurance staff. Sending a knowledgeable, experienced QA manager to live in China and oversee the production on a daily basis will ensure that standards are being met. Otherwise lower-level personnel may make decisions that are not in the best interest of your company.

- Take nothing for granted, leave nothing to chance. You may expect that purchasing supplies from the local branch of a known, international brand means that you can assume it will meet that company’s standards as well as your own. This is not necessarily the case in China. You have to think differently and conduct due diligence with every supplier.

- Ensure that management and oversight extends beyond first-tier suppliers. It is important to have oversight of secondary and tertiary suppliers as well—and may, in fact, be even more critical. Understanding the incentive and motivation for economic adulteration will also help in prevention.

- Companies can have good equipment and facilities, but lack process control and management practices to operate properly. You can buy an existing plant, but you have to ensure it is set up and maintained properly. Don’t be lulled into thinking you have it under control when you really don’t.

- Guard against changes to the product, process, or facility. Ensure that this is not simply an expectation, but that everyone understands the standards and why they are important. Tolerate no shortcuts.

- Understand the use and misuse of documents. Certificates of Analysis often have little value, as it is common culture to simply print these without adequate backing or certification. This also is where testing becomes critical—you will need to do more incoming testing to validate supply quality and authenticity.

- Place staff at supplier’s facility. While you can’t completely prevent issues, being onsite can help circumvent them.

- Purchase from a new supplier only after an on-site audit by you or a reliable third party. Always thoroughly check out suppliers before you use them.

- Conduct spot checks/screening for known and unknown economic adulterants. Testing is critical, and the more remote the supplier, the more important testing becomes.

All that said, there is an old saying, “Imitation is the sincerest form of flattery.” If you make a product in China and it’s not subject to being copied, you should be insulted.

No comments:

Post a Comment